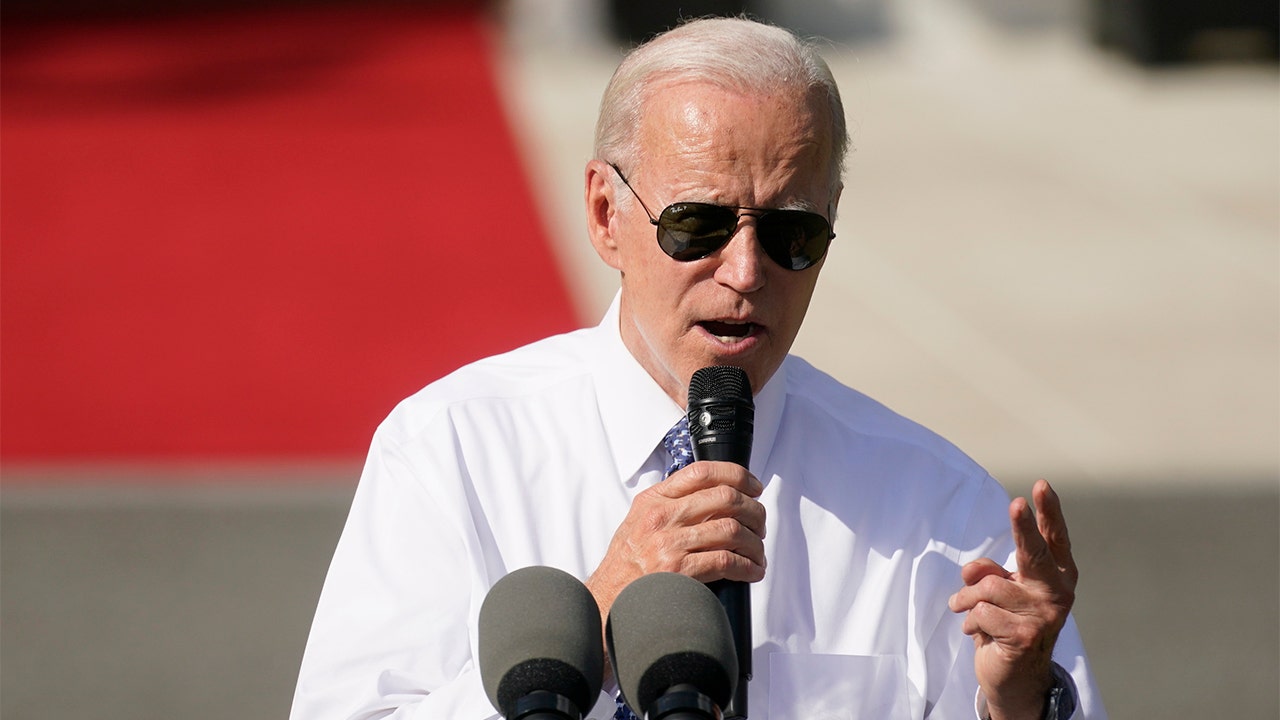

In the complex tapestry of American taxation, President Joe Biden recently posed a question that reverberated through the political landscape: “What if we could fundamentally restructure how we think about taxes?” This query not only invites contemplation but also implicitly challenges the status quo, encouraging a re-examination of tax policy as it stands.

Biden’s administration has consistently advocated for a more equitable tax system. The crux of the matter rests on the perception that the wealthy are often shielded from their fair share of taxation. One could argue, based on burgeoning economic disparities, that a fiscal paradigm shift is overdue. Yet, what would this entail? The president’s remarks suggest an inclination toward progressive taxation, wherein higher income brackets contribute a more significant proportion of their earnings to the public purse.

Such a transformational approach raises a series of questions. Could this lead to increased revenues that would fund essential programs—education, healthcare, and infrastructure? Or would it spawn dissent among those who perceive it as punitive? It is vital to scrutinize this proposed vision from various angles. For instance, while the intent may be to alleviate burdens on middle and lower-income groups, opposition often arises from those concerned about the implications of wealth redistribution.

Moreover, it’s essential to address the skepticism surrounding government efficiency. Many Americans harbor doubts about whether tax revenues are allocated judiciously. The concern is not merely about how much tax is paid, but how those funds are utilized. Would a restructured tax system truly lead to a tangible enhancement in public services, or would it squander public trust?

Furthermore, the dialogue surrounding tax policy is inexorably linked to broader economic conditions. As inflation and cost-of-living challenges mount, the timing of such proposals may appear fortuitously strategic—or dangerously misguided. In this context, Biden’s question invites further exploration: can the government navigate the delicate balance between necessary taxation and fostering economic growth?

As policymakers deliberate these critical issues, citizens are left to ponder the implications of Biden’s playful yet provocative query. Undoubtedly, the conversation surrounding taxes is far from settled. It serves as a reminder that the fundamental relationship between citizens and their government, particularly in fiscal matters, is as dynamic as it is contentious. How will Americans respond to this challenge? Only time will reveal the intricate tapestry woven from these dialogues.