In today’s fast-paced economic environment, securing funding for your business has become a pivotal concern for entrepreneurs. One viable option that has garnered considerable attention is the Kabbage Line of Credit. This flexible financial solution is designed not only for new ventures but also for established businesses in need of capital for various operational requirements. Understanding how to apply for a Kabbage Line of Credit can empower business owners to grasp the necessary funds to facilitate growth, manage cash flow effectively, and navigate unforeseen challenges.

Understanding Kabbage: A Brief Overview

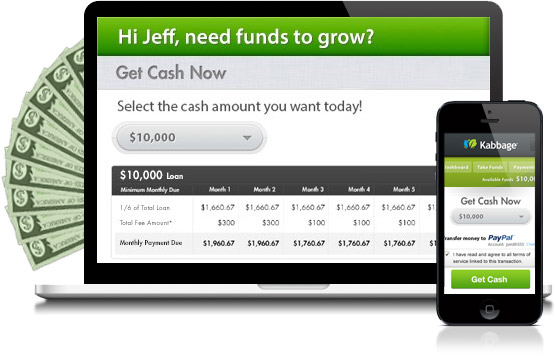

Kabbage emerged in the financial sector as a reputable online lender offering lines of credit to small businesses. With a straightforward application process and quick approval times, it has distinct advantages over traditional banking methods. This service primarily caters to businesses with a need for accessible and immediate funds, allowing owners to draw on their credit as needed, similar to a credit card. Kabbage’s model is particularly attractive for its emphasis on technology, providing a seamless user experience.

Why Consider a Kabbage Line of Credit?

Before diving into the application process, it is essential to understand why a Kabbage Line of Credit might be the right choice for your business. Some compelling reasons include:

- Flexible Access to Funds: You can withdraw as little or as much as you need, up to your credit limit, without the obligation to use the entire amount.

- Fast Funding: Once approved, funds can be deposited into your business account as quickly as the same day.

- Simple Repayment Terms: Kabbage offers a straightforward repayment structure with flexible payment schedules based on your cash flow.

- No Hidden Fees: Transparency in terms of fees and rates allows for informed financial decision-making.

Eligibility Criteria: Who Can Apply?

Before applying, it is crucial to determine if your business meets Kabbage’s eligibility requirements. These criteria typically include:

- Minimum Revenue: Your business should generate a minimum annual revenue, frequently around $50,000, although this amount can vary.

- Time in Operation: Kabbage often prefers businesses that have been operational for at least one year.

- Business Type: Most types of registered businesses qualify, including sole proprietorships, partnerships, and corporations.

Step-by-Step Guide to Applying for a Kabbage Line of Credit

Applying for a Kabbage Line of Credit involves a systematic approach. Follow these steps to streamline the process:

- Gather Necessary Documents: You’ll need information about your business’s revenue, bank statements, and possibly other financial documents. Having these easily accessible will expedite your application.

- Visit the Kabbage Website: Navigate to the official Kabbage site to initiate the application. User-friendly interfaces make this step relatively straightforward.

- Complete the Application Form: Fill out essential details, including your business name, contact information, and revenue figures. Kabbage employs a quick online application process, often taking only a few minutes.

- Link Your Business Bank Account: Kabbage requires access to your business bank accounts to analyze your financial health. This step is vital for assessing your eligibility.

- Review Your Terms: Upon approval, Kabbage will present your credit limit and associated fees. Careful review of these terms ensures that you are fully informed before accepting the line of credit.

- Access Your Funds: After acceptance, you can withdraw cash as needed up to your limit. Kabbage provides a dashboard to track your available credit in real time.

Utilizing Your Kabbage Line of Credit Responsibly

While having access to a line of credit can be a boon, it also necessitates prudent management. Here are some strategies to maximize the benefits:

- Assess Your Needs: Before accessing funds, ensure you have a clear understanding of the specific purpose and potential return on investment.

- Create a Repayment Plan: Establish a solid repayment schedule to avoid falling into a cycle of debt. Consistent payments can enhance your business credit score.

- Monitor Your Usage: Keep track of how much you draw and ensure it aligns with your business’s cash flow. Avoid withdrawing excessively, which can lead to financial strain.

Understanding the Costs Involved

While Kabbage offers significant advantages, it’s crucial to understand the costs associated with a line of credit. Kabbage typically charges a monthly fee based on your draw amount, which varies according to the credit terms. This fee structure can be more expensive than traditional loans, so conducting a comprehensive cost-benefit analysis is vital.

Final Thoughts

Securing a Kabbage Line of Credit can be a transformative step for your business, offering the financial flexibility needed to thrive in a competitive landscape. By adhering to the eligibility requirements, following the application process diligently, and managing funds wisely, you can harness this financial instrument to propel your operations forward, tackle challenges head-on, and seize growth opportunities. Remember, informed decision-making empowers your venture; being financially literate is just as important as the funding itself.