Home insurance is an essential consideration for homeowners in Myrtle Beach, South Carolina. This coastal paradise, known for its pristine beaches and bustling tourist attractions, is also susceptible to specific risks that can significantly influence insurance rates. Understanding the average cost of home insurance, the factors that impact these costs, and the various types of coverage available can empower homeowners to make informed decisions.

As of recent reports, the average cost of homeowners insurance in South Carolina hovers around $1,354 annually. However, Myrtle Beach homeowners might find their rates vary widely based on several contributing factors. These can include the location within the city, the type and age of the home, the coverage options selected, and the homeowner’s claims history.

Myrtle Beach’s geographical positioning presents unique challenges. Coastal properties, for instance, often face a higher risk of hurricane damage and flooding, leading insurance companies to adjust their premiums accordingly. Homes situated in flood-prone zones may require additional flood insurance, which is an indispensable element of financial security in these regions. Homeowners should evaluate flood zone maps to ascertain their risk and consider options for supplemental coverage.

Moreover, the age and condition of a home significantly affect insurance rates. Older homes, while charming, often lack the modern safety features that mitigate fire and structural risks. Electrical systems, plumbing, and roofing materials become pivotal factors in determining insurance premiums. Insurers typically regard homes equipped with modern wiring and updated plumbing systems as lower risk, potentially resulting in more favorable rates.

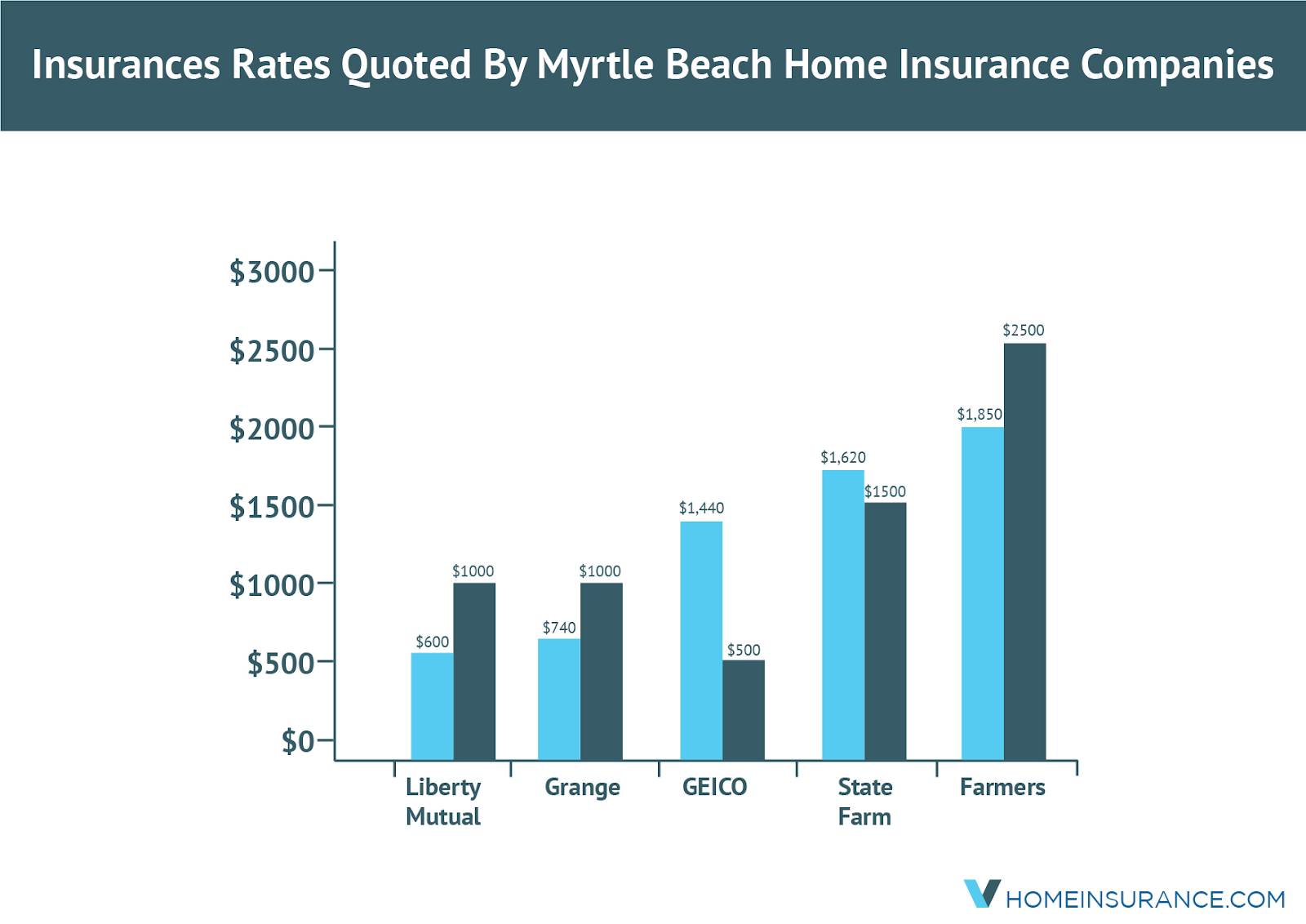

The insurer’s underwriting criteria also play a pivotal role in determining home insurance costs. Each insurance company has its unique set of guidelines and risk assessments, which means that two homeowners in similar situations might receive dramatically different quotes. It is advisable for homeowners to conduct a thorough comparative analysis of multiple insurance providers to secure the most advantageous rates. Additionally, bundling home insurance with auto or life insurance can present cost-saving opportunities.

Another critical element to consider is the chosen level of coverage. Homeowners have multiple options available, including actual cash value (ACV) or replacement cost valuation. An ACV policy compensates the homeowner for the depreciated value of the home and personal belongings, while a replacement cost policy provides funds for the full amount needed to rebuild or replace without a depreciation deduction. The latter can lead to higher initial premiums but offers greater long-term financial security.

Furthermore, many Myrtle Beach homeowners might consider endorsements and riders, which are additional coverages that can be attached to their primary policy. These options allow homeowners to customize their insurance to suit their individual needs. For instance, coverage for personal belongings, jewelry, or home business equipment can be enhanced through specific endorsements. Similarly, identity theft protection is increasingly becoming a popular addition, reflecting growing concerns in our digital world.

Deductibles are another factor impacting premium costs. Homeowners can often choose between higher or lower deductibles—amounts they would pay out-of-pocket before insurance kicks in. Selecting a higher deductible can decrease monthly premiums, yet it also means more substantial upfront costs in the event of a claim. It’s essential for homeowners to strike a balance between manageable premiums and an affordable deductible when evaluating their policy options.

Moreover, understanding the claims process and how it may influence future premiums is essential. If a homeowner has a history of frequent claims, insurers may perceive them as a higher risk, ultimately resulting in increased premiums at renewal. Homeowners should therefore be strategic about claims, considering whether minor damages warrant insurance intervention or if they might be better off managing the repairs independently.

It’s also pertinent for homeowners to take proactive measures that could potentially lower their insurance costs. Implementing safety features such as smoke detectors, security systems, and storm shutters can not only protect the property but may also qualify homeowners for discounts with their insurer. Moreover, regular maintenance, including roof inspections and tree trimming, can mitigate risks and fortify a homeowner’s position during an insurance evaluation.

Lastly, considering the long-term implications of climate change on home insurance is of utmost importance. Rising sea levels and increased storm intensity can pose ongoing threats to coastal areas such as Myrtle Beach. Homeowners must remain vigilant and informed about changes in regional weather patterns, adjusting their insurance strategies accordingly. It is prudent for homeowners to engage with their insurance agents regularly, re-evaluating their coverage as new information becomes available.

In conclusion, the average cost of homeowners insurance in Myrtle Beach can be influenced by various factors, including location, home characteristics, and the chosen coverage. Deciphering the complexities of home insurance—ranging from types of policies to deductibles—enables homeowners to navigate their options effectively. By prioritizing safety measures and staying informed about environmental changes, Myrtle Beach residents can better prepare themselves against the unpredictable nature of coastal living.