When considering the landscape of entrepreneurship in New Jersey, have you ever wondered what it truly means to form a Limited Liability Company (LLC)? This question is crucial for many aspiring business owners who are keen to navigate the complexities of establishing a legal entity. However, while the journey can be rewarding, it also poses challenges. Business owners must be well-informed to make strategic decisions that benefit their enterprises in a highly competitive environment.

The decision to form an LLC in New Jersey is multifaceted. As a business structure, an LLC provides an amalgamation of both corporate and partnership advantages, rendering it an appealing option for many. Within the granules of New Jersey’s commercial terrain, understanding the benefits is essential for profitability and sustainability.

Liability Protection

One of the most significant advantages of forming an LLC is the protection it affords its owners, also known as members, against personal liability. Members are not personally responsible for the debts and liabilities incurred by the company. This protective barrier enables entrepreneurs to engage in business activities without the constant fear of personal financial ruin. In a state where litigation is prevalent, this factor becomes overwhelmingly important.

Flexibility in Management

Unlike traditional corporations, LLCs offer heightened flexibility regarding management structures. Members may choose to manage the business themselves or appoint managers, permitting a tailored approach that meets the operational needs of the entity. This versatile framework empowers members to capitalize on individual strengths and expertise, promoting an enriched management dynamic. Furthermore, there are fewer formalities and ongoing requirements compared to corporations, which can streamline processes significantly.

Tax Benefits

On the financial front, an LLC in New Jersey enjoys considerable tax advantages. This business structure is typically classified as a pass-through entity. Therefore, profits and losses are reported on the individual tax returns of the members, thus circumventing double taxation generally imposed on corporations. The simplicity of this tax arrangement provides an attractive financial benefit for many small business owners looking to optimize their revenue streams.

Moreover, New Jersey is known for its economic incentives designed to attract and support small businesses. Various tax credits and grants may be available, especially for those who commit to environmentally sustainable practices. This dual benefit amplifies the importance of understanding local regulations and opportunities.

Enhanced Credibility

Establishing a limited liability company can significantly enhance a business’s credibility. Customers and clients often perceive LLCs as more legitimate and professional compared to sole proprietorships or partnerships. This perception can prove vital in establishing trust and securing contracts in sectors where reputation is paramount. Businesses that can effectively communicate their LLC status may also attract higher-quality partnerships and investments.

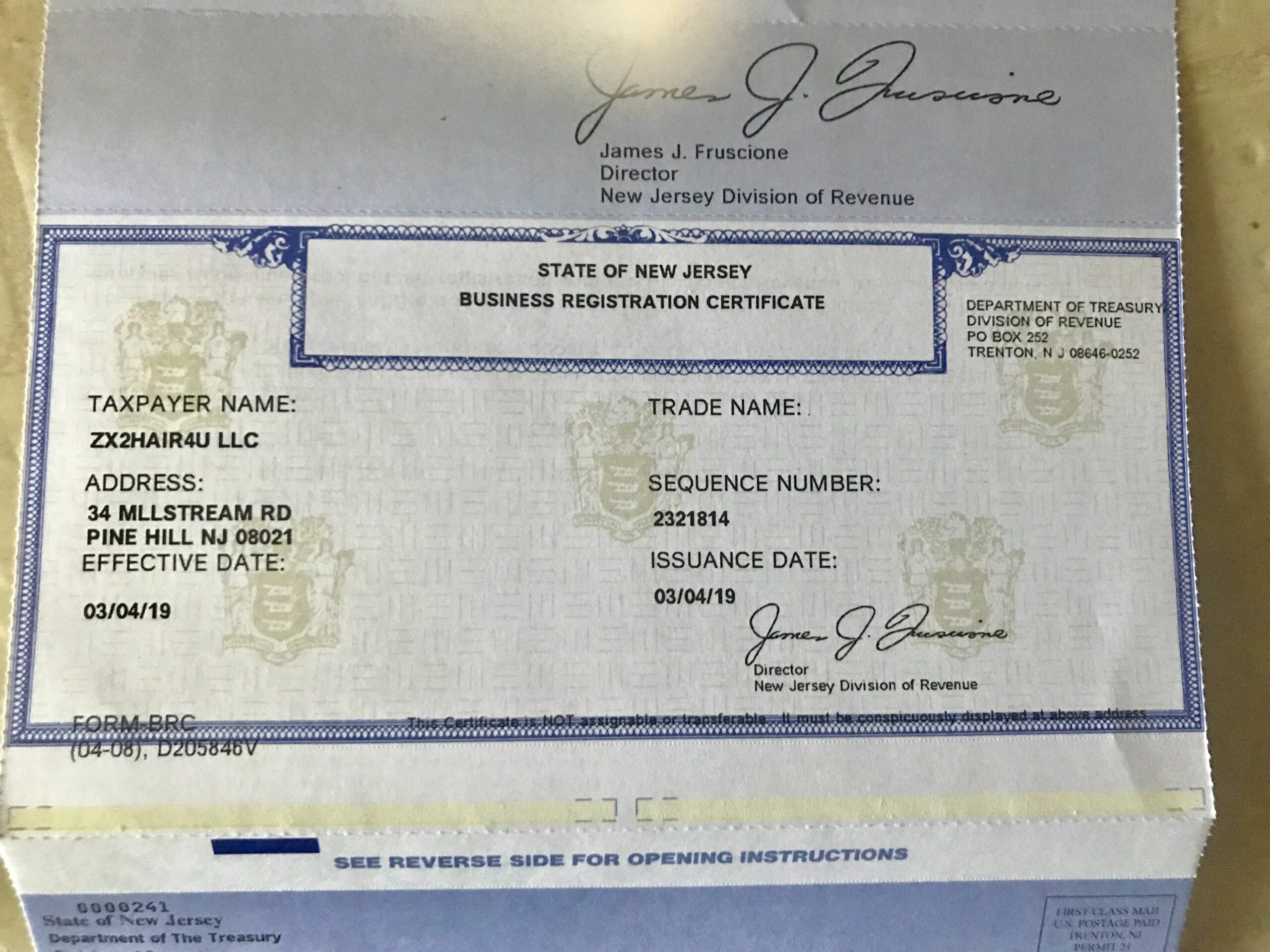

Ease of Formation

The formation of an LLC in New Jersey is relatively straightforward, a fact that contributes to its growing popularity among entrepreneurs. New Jersey’s Division of Revenue and Enterprise Services provides a streamlined process for filing the Certificate of Formation online. This accessibility reduces bureaucratic hurdles, allowing entrepreneurs to concentrate on their core business activities rather than getting bogged down in red tape.

However, while the formation may be easy, it comes with continued responsibilities. The challenge lies in adhering to compliance obligations, including filing annual reports and maintaining good standing with the state. Business owners must navigate these requirements carefully to avoid potential pitfalls, as varying regions may enforce different regulations.

Intricate Record-Keeping

An often-overlooked facet of managing an LLC is the necessity for diligent record-keeping. Documenting financial transactions, contracts, and meeting minutes not only fortifies the legal standing of the LLC but also contributes to effective business management. By maintaining clear and organized records, entrepreneurs can mitigate the risks associated with misunderstandings and disputes within the company or with outside entities.

Access to Legal Resources

Another benefit of forming an LLC is the opportunity to access legal and financial resources more readily. Many law firms and financial advisers specialize in LLCs and can provide crucial insights that enhance operational efficiency. Establishing an LLC position gives entrepreneurs leverage in negotiating contracts, creating partnerships, and establishing relationships with banks. Having legal representation may also assist in navigating the sometimes murky waters of business law, particularly relating to environmental regulations and practices.

Networking Opportunities

In an age where collaboration can be the key to success, forming an LLC opens the door to invaluable networking opportunities. Many chambers of commerce and business associations provide resources tailored specifically for LLCs. These organizations host events focused on connecting entrepreneurs, creating synergies that can lead to innovative solutions and joint ventures. Being part of a broader community of business owners can spark new ideas and foster an environment conducive to sharing knowledge and experiences.

Conclusion: Navigating the Terrain

While the benefits of forming an LLC in New Jersey are manifold, it is imperative to approach this venture with both enthusiasm and caution. The entrepreneurial landscape is rich with opportunities, yet it is littered with complexities that require diligence and informed decision-making. As you consider your business’s future, contemplate the interplay of benefits and challenges with a thoughtful mindset, ensuring that your LLC serves not only as a protective framework but also as a springboard for sustainable growth and success.