Buying a house in Texas as a non-resident can be an extraordinary journey filled with unique opportunities and challenges. Known for its vast landscapes, vibrant cities, and rich culture, Texas offers an exciting real estate market that draws individuals from all over the globe. Whether you are relocating for a job, investing in property, or searching for a second home, understanding the nuances of the Texas real estate market is essential. This guide delves into the multifaceted process of purchasing property in the Lone Star State as a non-resident.

Understanding Texas Real Estate Laws

Texas is distinct in its real estate regulations, which can vary significantly from those in other states or countries. Familiarizing yourself with local laws is the first step in navigating the complexities of this market. In Texas, there are no restrictions on foreign buyers purchasing property. Non-residents can freely own land, residential, and commercial properties. However, knowing your rights and responsibilities is paramount. Engaging a knowledgeable local real estate attorney can aid in clarifying legal terminology and prevailing regulations.

Engaging a Local Real Estate Agent

Finding a reputable real estate agent with local expertise is a cornerstone of a successful property purchase. These professionals can offer insights into the nuances of neighborhoods, market trends, and pricing strategies. When selecting an agent, ensure they have experience working with non-residents; familiarity with the idiosyncrasies of international buyers is invaluable. Look for agents who leverage technology to streamline the buying process, as digital tools can facilitate remote communication and assistance.

Understanding Financing Options

Financing a home in Texas as a non-resident can differ from that of a resident. Many banks and lending institutions may have specific requirements for non-resident buyers, including higher down payments and interest rates. It’s prudent to explore various mortgage products and financing options available to international buyers. Investigate international banking options, as some banks offer specialized loans tailored to non-residents. Consulting with a mortgage broker can also provide clarity on financial choices and implications.

Researching Locations and Neighborhoods

The diversity in Texas neighborhoods is remarkable, each offering distinct atmospheres and amenities. From the bustling streets of Austin, known for its music scene and tech innovation, to the historic charm of San Antonio, there’s something for everyone. Research is key—evaluate factors such as local schools, crime statistics, public transport options, and overall community vibe. Utilize online resources like neighborhood profiles or local forums to glean personal experiences from current residents. Ensuring alignment with your lifestyle preferences is integral for long-term satisfaction.

The Home Buying Process

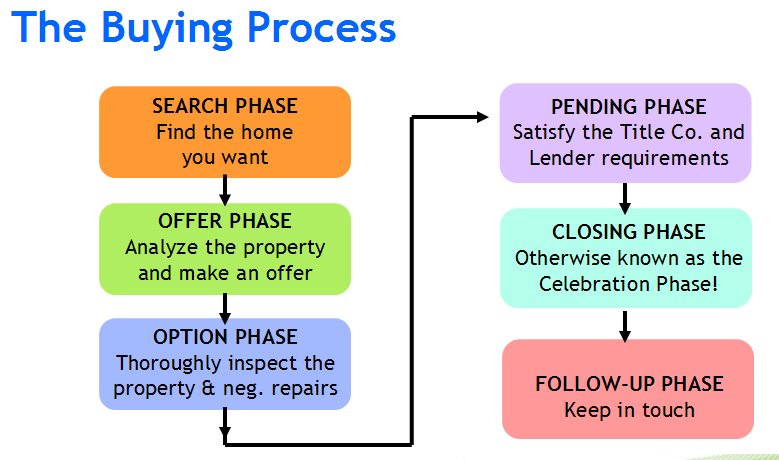

The home buying process in Texas generally includes several stages. After identifying the right property, the next step is to submit an offer. This often involves negotiation, wherein your real estate agent plays a crucial role, ensuring your interests are represented fairly. Once the offer is accepted, conducting a thorough home inspection is vital, as it helps to uncover any potential issues prior to finalizing the sale.

Escrow will typically follow, where an independent third party holds the buyer’s deposit while performing due diligence on the transaction. During this period, ensuring all contractual stipulations are met is vital, and having a local attorney can be beneficial. Once the paperwork is finalized and financing is secured, you will proceed to closing. This final step involves signing documents and transferring ownership.

Understanding Taxes and Additional Costs

While the allure of Texas real estate is undeniable, potential buyers must also consider the tax implications associated with purchasing property. Property taxes in Texas can be relatively high compared to other states. Familiarize yourself with the local tax structure, which varies by county, to avoid unexpected financial burdens. Additionally, be aware of closing costs, which typically include fees for title insurance, appraisal, and inspections. The total can range from 2% to 5% of the purchase price, so budgeting appropriately is crucial.

Property Management Considerations

If you are purchasing an investment property or a second home that you may not occupy year-round, hiring a property management company may be beneficial. These professionals handle tenant relations, maintenance, and other operational responsibilities that can prove time-consuming. Selecting a reliable management service can preserve the value of your investment and provide peace of mind, especially if you are overseas or live far away.

Building a Local Network

Integrating into the local community can enhance your experience as a non-resident homeowner. Building relationships with your neighbors, local business owners, and community organizations can provide support and valuable insights. Consider participating in social events, volunteer opportunities, or local clubs to establish connections and foster a sense of belonging in your new environment.

Conclusion

Purchasing a home in Texas as a non-resident is undoubtedly an exhilarating venture. With the right preparation, research, and local support, you can navigate this exciting market with confidence. Cultivating relationships with local professionals, understanding financing options, and immersing yourself in community life will all contribute to a fulfilling home buying experience. Texas is a place where dreams become reality, and owning a piece of this vibrant state can serve as both an investment and a gateway to a new lifestyle.