In the bustling realm of small business, partnerships can be both a boon and a bane. When visions align, the synergy created can propel a venture to remarkable heights. However, with the passage of time, circumstances may evolve, leading to the disquieting need for a buyout. Buying out a partner in your small business is a nuanced process—fraught with implications that transcend mere financial transactions. It demands consideration of emotional ties, contractual obligations, and strategic foresight.

Understanding the impetus for a buyout is critical. Many entrepreneurs enter partnerships envisioning collaborative growth, but unforeseen challenges can create friction. It might pertain to divergent values, conflicting management styles, or even personal issues that creep into the professional domain. In other instances, a partner may wish to retire or shift their focus to different pursuits, which can create a void in business operations. Whatever the case, acknowledging the underlying motivations behind the desire for separation can pave the way for a smoother transition.

Once the decision to pursue a buyout is made, the first step lies in assessing the partner’s equity in the business. Often, valuations can be contentious, as each party may harbor differing perspectives on the worth of the enterprise. Engaging a qualified appraiser can mitigate disputes; they will evaluate various factors, including assets, liabilities, and market conditions, to arrive at a fair market value. This prudent approach not only aids in accurate valuation but also fosters transparency, ensuring both parties feel respected throughout the process.

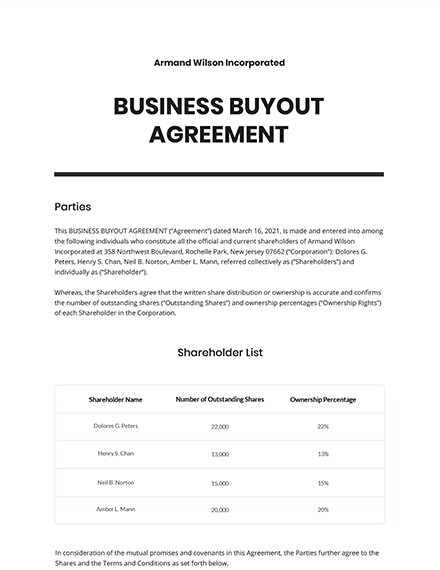

Next, drafting a comprehensive buyout agreement is paramount. This document acts as the cornerstone of the transaction, delineating the terms under which the buyout will occur. Crucially, it should encompass payment structures, timelines, and contingencies—provisions that protect both the exiting partner and the remaining business. Articulating these details can circumvent future misunderstandings or legal entanglements. The buyout agreement may also touch on aspects like non-compete clauses and intellectual property rights to safeguard the business’s interests moving forward.

At this juncture, it is vital to consider financing options for the buyout. The exiting partner has invested time, resources, and labor into the business, thus elucidating a significant financial obligation for the surviving partner. Various avenues exist, each imbued with distinct advantages and disadvantages. One common route involves securing financing through a bank loan or credit line. Alternatively, some entrepreneurs may opt for seller financing, allowing the remaining partner to make payments over a specified period. The choice of financing should align with the business’s cash flow and long-term financial strategy, taking care not to overextend resources in the throes of change.

Communication plays an indispensable role throughout the buyout process. Ensuring that employees, clients, and stakeholders are kept informed can mitigate unrest and preserve the stability of the business. The specter of uncertainty can lead to attrition, impacting morale and productivity. Crafting a thoughtful communication strategy demonstrates leadership and fosters trust, encouraging the remaining team members to focus on their roles in propelling the business forward.

In the throes of a buyout, it is paramount to remain mindful of legal implications. Engaging a legal professional with experience in business partnerships is advisable to navigate the intricate web of regulations and obligations inherent in such transitions. They will ensure that all legalities are meticulously adhered to, reducing the potential for future disputes. This safeguarding is most vital in drafting contracts and agreements as well as in addressing any tax liabilities that may arise from the transfer of ownership.

Moreover, a pivotal, yet often overlooked factor in a buyout is emotional intelligence. The process can evoke a confluence of feelings: relief, anxiety, disappointment, or even elation. Acknowledging these emotions not only helps in managing personal reactions but also aids in recognizing how these feelings may impact business operations. Setting aside personal grievances and focusing on constructive dialogue can transform a daunting buyout into a strategic opportunity for renewal.

Having traversed through the technical aspects of a buyout, it becomes essential to recalibrate the business vision post-buyout. The landscape may have altered dramatically, and the remaining partner must seize the moment to redefine objectives and realign the business’s trajectory. This period is ripe for innovation and revitalization, where fresh strategies can blossom unencumbered by past conflicts. Embracing change and fostering a culture of adaptability will not only fortify the business but also embolden its resilience against future challenges.

Finally, it is worthwhile to reflect on the lessons learned throughout the buyout process. With partnerships being intricate relationships, extracting insights from the transition can be profoundly beneficial. What worked well? What could have been handled differently? These contemplations can foster both personal growth and professional development, enhancing future collaborations and contributing positively to the business ecosystem.

Buying out a partner in your small business is undoubtedly a complex endeavor. Yet, the reward can manifest as a renewed vision for the future, freeing one from the constraints of a partnership that no longer serves one’s aspirations. By embracing the multifaceted nature of the process—valuing open communication, legal diligence, emotional understanding, and strategic foresight—entrepreneurs can navigate this intricate journey with both poise and purpose, crafting a business landscape that reflects their true ambitions.