When considering the tumultuous journey of stock compensation, particularly Restricted Stock Units (RSUs), one must navigate a labyrinthine terrain that is replete with tax implications. This journey becomes all the more intricate when intertwining the allure of relocating from a state like California, known for its sunny disposition and equally bright tax burdens. In this piece, we will unpack the nuances of how moving out of California impacts your RSU taxation and the myriad considerations involved in this intricate dance.

To frame the discussion, imagine your RSUs as vibrant, precious gems kept in a vault; while they glimmer with potential value, they also bear the weight of taxes that can diminish their splendor upon the moment they are released into your possession. The critical question arises: Where should one position themselves in relation to these gems when the time comes to unearth their worth? The answer is as multifaceted as the gems themselves.

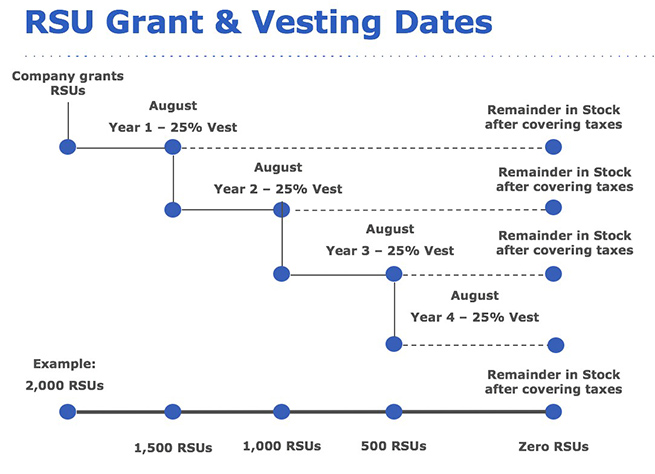

First, let’s delve into the nature of RSUs. These units represent a promise from your employer to grant you shares of stock at a specified future date, often contingent upon your continued employment. Unlike traditional stock options, which require you to purchase shares, RSUs are granted to you outright, usually upon vesting. Their value, however, comes with strings attached; they are treated as ordinary income upon vesting, subjecting you to federal income tax, state income tax, and FICA taxes. This is where California’s aggressive tax policies come into play.

California is notorious for its steep tax rates, sitting among the highest in the nation. For the fortunate few whose RSUs vest while a resident of the Golden State, this means a sizable chunk of their gains could be spirited away by the state treasury. Therefore, the prospect of relocating holds an intoxicating appeal for those seeking to escape this fiscal labyrinth.

However, the allure of lower tax rates does not come without its own set of complications. When one decides to move out of California, particularly to states with no personal income tax such as Texas or Florida, the question arises: How will the state of California handle the taxation of those RSUs that vest after leaving the state? To answer this, we must understand the concept of source income.

California asserts tax jurisdiction over income generated within its borders. Thus, if RSUs vest while you remain a California resident, the state will claim its due, regardless of where you ultimately reside when the shares are sold. This necessitates a strategic assessment of timing in relation to your move. Planning your departure date around the vesting schedule of your RSUs can yield significant tax savings, akin to timing your harvest for the best yield.

In contemplating this timing, one must also consider the residency determination period. California employs a multi-faceted test to determine residency status, encompassing where you spend your time, where your family resides, and where your principal home is located. If you sever ties too abruptly, you may find yourself entangled in a tax web, inadvertently retaining residency status, thereby subjecting your RSU income to California’s taxation despite your physical absence.

Furthermore, if RSUs have vested while residing in California, it is pivotal to maintain meticulous records. When selling the shares, you will incur capital gains taxes on any appreciation post-vesting. The stakes rise when the taxable amount is influenced by the length of time you hold the shares after they vest. Therefore, holding your RSUs for a longer duration post-vesting while residing in a more tax-friendly state can yield favorable financial outcomes, echoing the concept of ‘patience is a virtue.’

Additionally, it is imperative to consider the implications of the federal tax code. The IRS mandates that RSUs be included in your taxable income for the year they vest. Thus, even while enjoying the moderation of a non-tax state, you will still equate the reportable income to the federal level. It is equally essential to consult with a tax professional to ensure full compliance, navigating the choppy waters of both federal and state tax obligations that may arise from such a transition.

Moreover, the emotional ramifications tied to this major life change should not be disregarded. The decision to move from California, a state synonymous with innovation, creativity, and opportunity, may weigh heavily on the mind. It’s akin to leaving a vibrant garden behind, where the blossoms of camaraderie and collaboration thrive, in pursuit of a desert landscape promising simplicity and tax salvation. This metaphorical shift can create tension as you grapple with the benefits of financial relief against the vibrant backdrop of your current life.

In conclusion, the interplay of RSUs and state tax implications is a delicate choreography that requires careful planning, foresight, and an understanding of both financial and emotional landscapes. As you consider the enticing prospect of relocating out of California, remember that timing, residency, and meticulous record-keeping will be your guiding stars. Ultimately, while the allure of a lower tax burden may beckon you from afar, with calculated steps and a savvy approach, you can harvest your RSU bounty while sipping a proverbial piña colada from a beach that doesn’t come with an exorbitant tax bill. Embrace this journey with knowledge, for it is a path laden with potential if navigated thoughtfully.