When the unexpected happens, you expect your insurance company to have your back. But what happens when they unexpectedly cancel your policy? It can result in anxiety, financial uncertainty, and questions about your legal rights. In situations like these, many individuals wonder: can I sue my insurance company for cancelling my policy? The short answer is: perhaps. However, the process is nuanced and depends on various circumstances. This article will explore the complexities of this issue, shedding light on when legal action may be warranted, the grounds for suing, and what the implications of such a decision might be.

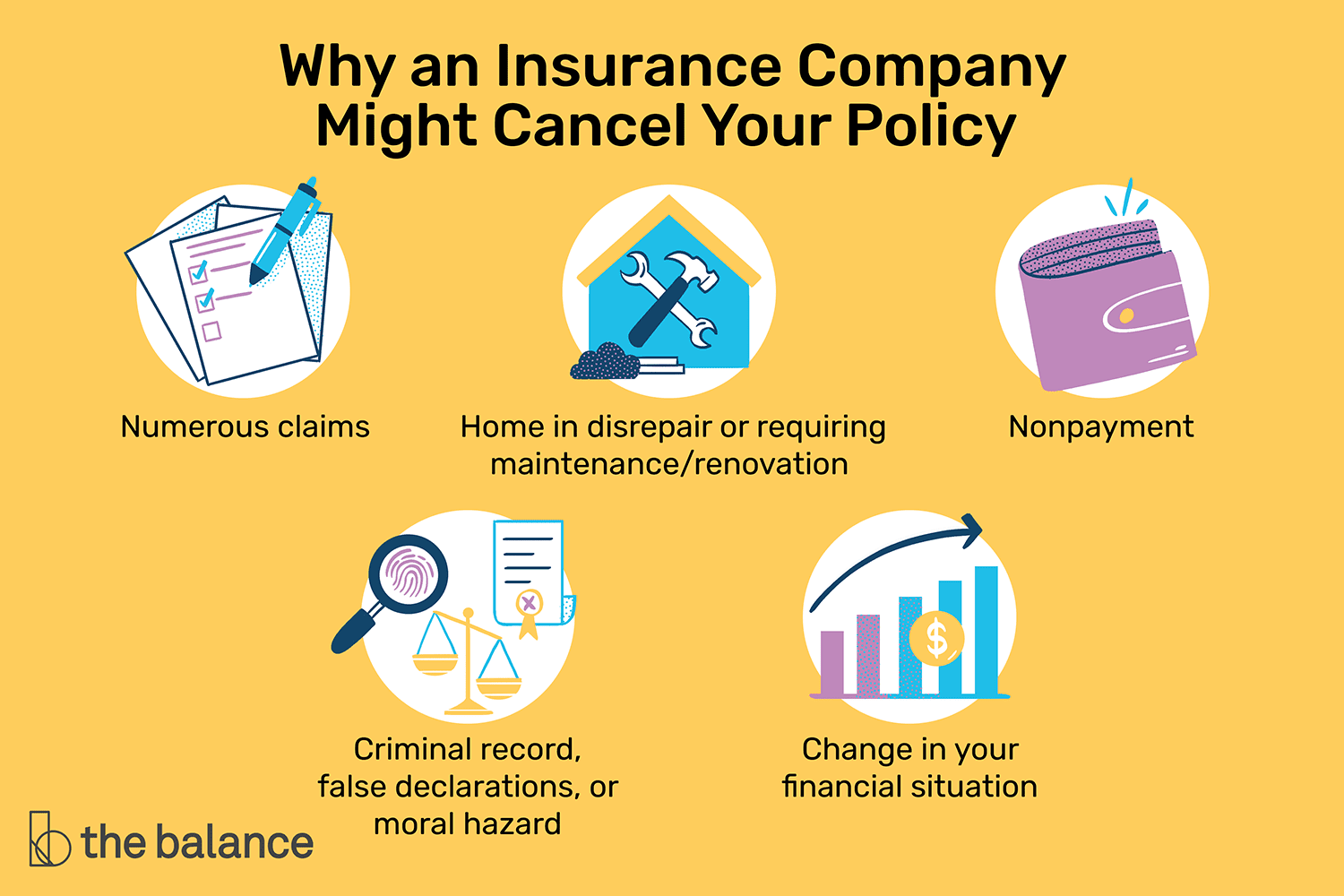

In the realm of insurance, policy cancellation can occur for numerous reasons—some valid, and others questionable. The most common grounds for cancellation include non-payment of premiums, fraud, or a significant change in risk associated with the policyholder. However, it’s essential to discern whether your insurance provider adhered to the stipulated laws and regulations regarding cancellation. If you believe they acted in bad faith or violated any contractual obligation, legal recourse might be an option.

To navigate this treacherous terrain, it’s crucial to understand the different types of insurance policies and the legal principles governing them. Whether you possess auto, health, homeowner’s, or life insurance, each type may have distinct guidelines regarding cancellation. For example, in many jurisdictions, auto insurance policies cannot be cancelled without proper notice, often framed within a 10 to 30-day window. If your insurer failed to comply with these notice regulations, you could have grounds to challenge the cancellation.

One of the fundamental concepts to grasp is the principle of “bad faith” insurance practices. This legal term refers to actions by insurance companies that are deceptive or unfair. If your insurer cancelled your policy without a legitimate reason or did not provide reasonable notice, it could be characterized as bad faith. Additionally, insurers are generally required to investigate claims thoroughly. Failing to do so before cancelling a policy can also open them up to potential lawsuits.

Determining your legal standing involves an in-depth examination of your policy documents. These documents outline the terms and conditions of your coverage. Pay special attention to the cancellation clause, as it details the conditions under which your policy can be lawfully terminated. If you find discrepancies between what your policy states and the actions of the insurer, you may be on solid ground to pursue legal action.

If you choose to move forward with a lawsuit, the process requires meticulous preparation. Document everything: correspondence with your insurer, payment records, and any relevant communication. This paper trail will be invaluable in substantiating your claims. Additionally, be mindful of the statute of limitations governing insurance disputes in your jurisdiction, as these time constraints can significantly impact your case.

Legal experts often recommend seeking the counsel of a qualified attorney specializing in insurance law. They can provide insights into whether your particular circumstances merit a lawsuit, taking into consideration the costs and potential outcomes associated with litigation. Sometimes, your attorney may recommend filing a complaint with your state’s Department of Insurance before pursuing further legal action. Regulatory bodies can often mediate disputes, offering a potentially less expensive and faster resolution than a courtroom battle.

When contemplating legal action against your insurance company, consider the potential outcomes. A successful lawsuit could result in the reinstatement of your policy, compensation for any consequential damages suffered due to the cancellation, or even punitive damages in extreme cases of bad faith. On the other hand, consider the possibility that pursuing legal action might lead to extended timelines, stress, and legal fees, which can quickly accumulate. Furthermore, avenues other than litigation, such as negotiation or mediation, may be more pragmatic for certain cases.

Let’s also address the emotional toll that losing your insurance can bring. Insurance serves not just as a legal contract, but a form of security and peace of mind. When it’s taken away, it can exacerbate feelings of vulnerability and stress. Thus, addressing the situation effectively is paramount for both your financial wellbeing and your mental health. During this period, leaning on friends, family, or even professional counselors can provide necessary emotional support.

In conclusion, while it is theoretically possible to sue your insurance company for cancelling your policy, the intricacies surrounding the issue necessitate careful consideration. By understanding your rights, the rationale behind the cancellation, and the detailed nuances of your policy, you will be better equipped to make informed decisions moving forward. With thorough documentation and informed legal guidance, you can navigate this complex landscape—aiming not merely to seek justice but to reclaim the protection you deserve.