The concept of a Power of Attorney (POA) is often synonymous with empowerment and decision-making authority—providing individuals the leverage to handle various matters on behalf of another. However, a frequently asked question arises: can a Power of Attorney change the beneficiary on a bank account? This inquiry is crucial for those who may need to delegate financial responsibilities but also wish to ensure that their intentions regarding asset distribution are clearly understood and respected.

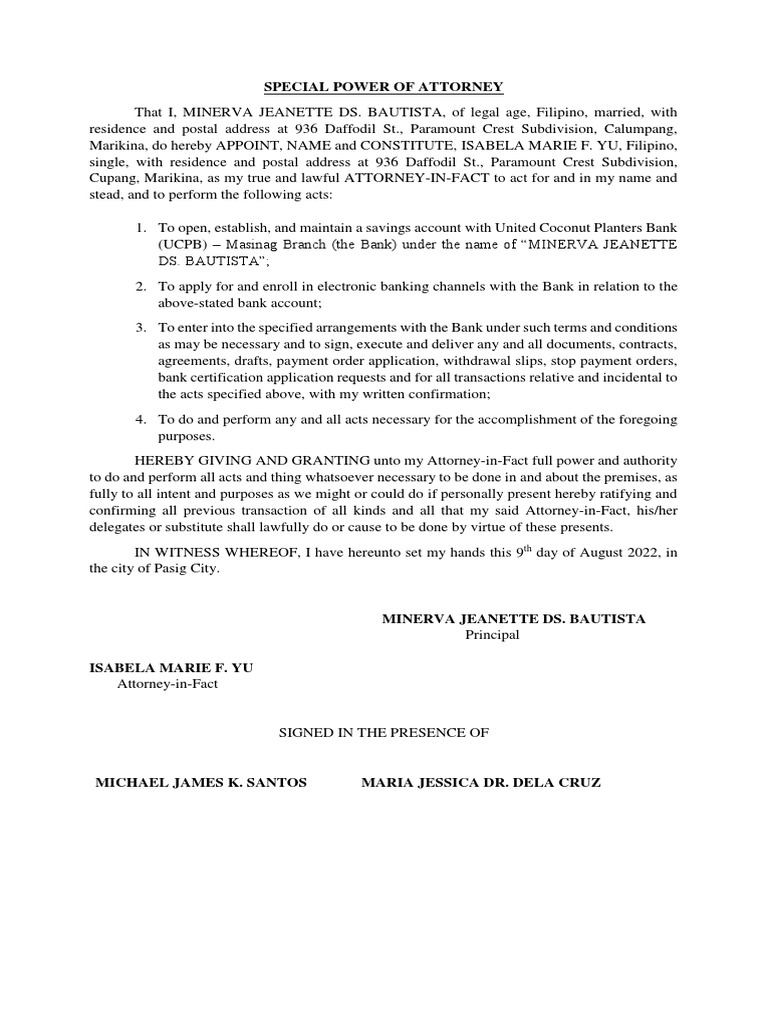

To unpack this question, we must first understand the essence of a Power of Attorney itself. At its core, a POA is a legal document that allows one person, the principal, to designate another person, the agent or attorney-in-fact, to act on their behalf. This can encompass a wide range of activities, from medical decisions to financial transactions. However, the authority granted by a POA is not uniform; it can vary significantly based on the type of POA established—general, durable, or limited.

Next, let’s delve into the relationship between a Power of Attorney and changing the beneficiary of a bank account. A beneficiary, in banking terminology, is an individual or entity designated to receive assets upon the account holder’s death. This distinction is crucial, as it lays the groundwork for understanding the limitations of a POA. Most financial institutions adhere to specific protocols concerning beneficiaries and POAs, rooted in legal standards designed to protect the account holder’s intentions.

The fundamental premise is that a Power of Attorney grants the agent the authority to act in the principal’s interests during their lifetime. However, can the agent alter who the beneficiary is set to be? The answer is not as straightforward as one might hope. In many jurisdictions, while a POA grants the agent extensive control over financial transactions, altering the named beneficiary may not be permissible. This restriction often exists to safeguard the principal’s original wishes, preventing potential exploitation or misunderstandings.

Nevertheless, there are exceptions. In some cases, if a POA specifically delineates the authority to change beneficiaries, the agent may be able to do so legally. This would typically be articulated in the POA document, clarifying the scope of authority granted. Hence, if a principal anticipates a need for flexibility in asset distribution or a shift in beneficiary intentions, such provisions can be thoughtfully incorporated into the POA. This foresight can avert complications during a time that may already be wrought with emotional and financial turmoil.

An essential aspect to consider is the relationship between the principal and the chosen agent. Entrusting someone with a Power of Attorney requires a significant level of trust, as the agent operates with a level of autonomy that could potentially impact the principal’s estate profoundly. This trust becomes even more paramount when the conversation shifts to beneficiaries, as the agent has the ability to influence not only financial situations but also family dynamics posthumously.

Moreover, the type of bank account involved can also influence the outcome. Joint accounts, for instance, complicate matters. If one partner holds a joint account with a different individual, the nature of beneficiary designation may differ, as the rights of both account holders can come into play. Should a Power of Attorney come into play in such scenarios, it may require careful navigation of joint ownership laws and the potential implications for all parties involved.

Understanding how different states and jurisdictions interpret the authority of a Power of Attorney is also pertinent. In some areas, state laws may place further restrictions on what an agent can do concerning beneficiaries. Therefore, it’s paramount to consult with a legal expert familiar with the specific provisions governing POAs in your locality. They can provide insight into fiduciary duties an agent bears and the potential legal ramifications that can arise from any modification to beneficiary designations.

It’s interesting to note that despite the perceived simplicity of changing a bank account beneficiary through POA, a deeper examination often reveals complexities that could necessitate a comprehensive review of estate planning. For instance, individuals may want to consider revocable trusts or other estate planning tools if they anticipate changes in beneficiaries frequently. Such mechanisms offer greater flexibility and can circumvent many of the pitfalls associated with altering beneficiary designations after the fact.

Finally, open communication amongst family members about financial intentions is vital. Whether the matters pertain to a Power of Attorney, joint accounts, or beneficiary designations, transparency can help mitigate misunderstandings and disputes after a principal’s passing. An uncomfortable conversation today can prevent significant heartache and contention tomorrow.

In conclusion, while a Power of Attorney can empower an individual to manage financial affairs, changing a bank account beneficiary can be fraught with legal and emotional complexity. The authority granted to an agent hinges on the specific language of the POA document and the prevailing laws in the jurisdiction. As such, before making assumptions about what is possible, a thoughtful and informed approach is paramount. Consulting with legal professionals can illuminate the path forward, ensuring that the principal’s wishes are faithfully honored while navigating the intricate web of financial responsibilities and familial relationships.