Have you ever pondered the intriguing question, “Can you really direct a Qualified Charitable Distribution (QCD) to a Donor Advised Fund (DAF)?” It’s the kind of question that might flit through your mind during a particularly dull meeting or perhaps while sipping your morning coffee. While this may seem like a straightforward inquiry, the answer delves into the intricate interplay of tax regulations, charitable intent, and financial planning strategies.

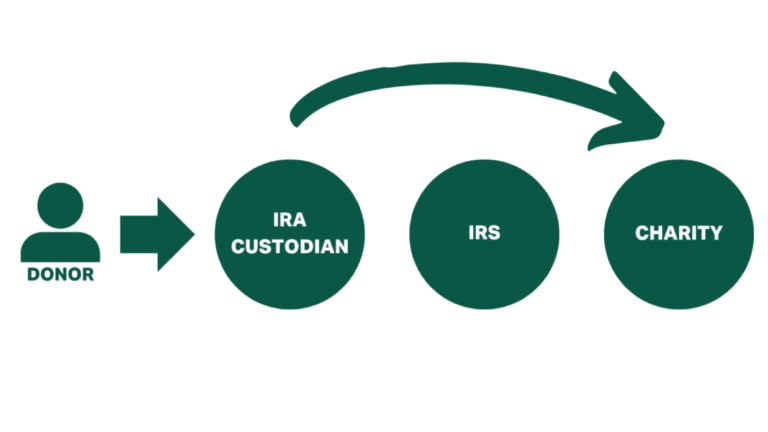

First, let’s dissect what a QCD truly is. A Qualified Charitable Distribution pertains to the direct transfer of funds from an Individual Retirement Account (IRA) to an eligible charitable organization. For individuals who are 70½ years old or older, this distribution not only satiates their philanthropic cravings, but it also has notable tax advantages. The beauty of QCDs lies in their ability to count toward the required minimum distributions (RMDs) without counting as taxable income.

Now, onto the Donor Advised Fund. These philanthropic tools function as a hybrid between a charitable giving account and a personal foundation. Individuals can contribute to a DAF, receive an immediate tax deduction, and then disburse the funds to charities over time at their discretion. With these two financial vehicles identified, the question arises: can one leverage the benefits of both a QCD and a DAF simultaneously?

As it turns out, the interplay between QCDs and DAFs can be more convoluted than one might hope. Generally speaking, the IRS does not permit QCDs to be directed to donor advised funds. Why? The rationale is rooted in the notion of immediate charitable intent versus the more deferential approach taken with DAFs. Since contributions to DAFs can be retained for future charitable purposes, the tax authorities deem them to be incompatible with the instant gratification intention of a QCD.

However, this doesn’t signify that there isn’t room for creativity in charitable planning. For instance, if you’ve already made your QCD to a qualified charity, you could, at a later time, contribute to a DAF using other funds. This strategy does carry a caveat, though: you won’t be able to claim the QCD as a deductible contribution if allocated to a DAF.

This regulatory framework sets a fascinating stage for strategic planning. One could argue that attempting to channel QCDs through a DAF might not simply be an exercise in futility but rather an exploration of what is possible within the confines of tax law. Should we throw caution to the wind and take bold steps, or do we meticulously navigate the rules laid out by the IRS? Crafting an effective strategy requires awareness, creativity, and, of course, a touch of humor about the rigmarole of tax regulations.

One effective approach may be to maximize QCDs alongside other charitable contributions. For instance, it may be prudent to utilize QCDs to fulfill RMDs, alleviating your tax burden while simultaneously making a tangible impact. By reserving additional contributions for your DAF, not only do you enjoy tax deductions, but you also maintain the flexibility to earmark those funds for future charitable distributions.

In practice, timing and strategy come into play. If you’re planning to contribute to a DAF, it makes sense to lay out a charitable giving timeline. This allows you to synchronize your QCDs and additional philanthropic efforts effectively. Consult with a financial advisor who understands the nuances of your financial situation. They may highlight additional methods of optimizing your giving, ensuring that every dollar serves a purpose.

Collaboration with financial professionals can indeed illuminate pathways less traveled in the charitable landscape. Lawyers, tax advisors, and wealth managers might provide insights that reflect your unique circumstances and goals, empowering you to structure your charitable contributions in a way that benefits not only your tax position but also the causes you cherish.

Yet, even as we navigate the labyrinthine confines of regulations, it’s essential to retain a sense of humor. After all, engaging in philanthropy is not just about numbers on a spreadsheet—it’s about changing lives and fostering communities. Finding innovative approaches to charitable giving can transform a mere obligation into a meaningful and gratifying experience.

Ultimately, while the IRS’s restrictions on QCDs directed toward DAFs might initially appear disheartening, they also open the door to an expansive horizon of philanthropic opportunities. With careful planning and strategic foresight, you can still engage in a charitable landscape that enriches both your financial life and the lives of those you wish to support.

So, next time the thought pops into your head about whether to do a QCD to a DAF, consider the broader spectrum of options at your disposal. The world of philanthropy is rich with potential; sometimes, it merely requires a tweak in perspective to unlock its true potential.