When it comes to saving for the future, many individuals consider Certificates of Deposit (CDs) as a viable option. They offer stability, predictability, and often higher interest rates than traditional savings accounts. However, one common question lingers for those looking to maximize their savings: can you add to a CD regularly? Let’s delve into the intricacies of this financial instrument and explore what options are available for making additional contributions.

First, it’s essential to understand what a Certificate of Deposit entails. A CD is a time deposit offered by banks and credit unions, requiring the investor to lock their funds for a predetermined duration in exchange for a fixed interest rate. This means once you open a CD, your money is committed for that duration, typically ranging from a few months to several years. However, the rules governing contributions can vary significantly depending on the institution and the type of CD.

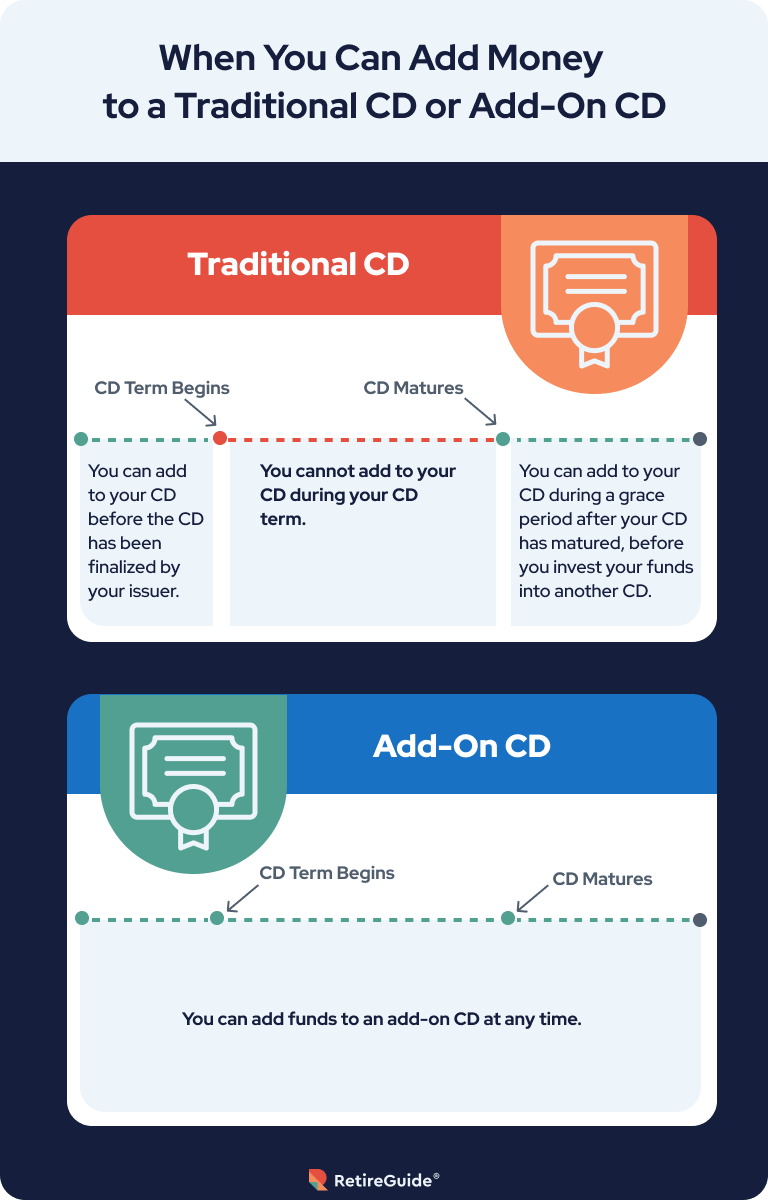

When it comes to the conventional standard CD, the answer to adding to it regularly is mostly a resounding no. Traditional CDs do allow for an initial investment, but they typically do not permit additional deposits throughout the term. This limitation is primarily designed to maintain the fixed interest rate for the duration of the term. Breaking the terms of a CD by adding funds can lead to penalties or the closure of the account altogether.

However, there’s a silver lining. Certain types of CDs, such as “add-on CDs” or “bump-up CDs,” provide more flexible options for investors. An add-on CD enables individuals to make additional contributions during the CD’s term, allowing savers to incrementally increase their deposit without losing the established interest rate. This feature can be especially advantageous for those who receive periodic bonuses, tax refunds, or simply want to bolster their savings over time.

Add-on CDs often come with specific rules regarding how much and when you can add money. For instance, some institutions may stipulate a minimum deposit requirement for each additional contribution, while others may limit the total amount that can be added during the term. It’s crucial to thoroughly examine the terms and conditions before committing to an add-on CD to avoid any unpleasant surprises.

Another accommodating option is the “bump-up CD.” This variant allows for one-time rate adjustments; the account holder can request a higher interest rate if the rates offered by the bank rise. While bump-up CDs do not allow for additional deposits in the same manner as add-on CDs, they provide an alternative means of maximizing earnings when market conditions change.

For those interested in more flexibility or a hybrid model, consider discussing options with financial advisors who may recommend staggered CDs or CD ladders. A CD ladder involves purchasing multiple CDs with varying maturity dates. This strategy allows investors to take advantage of higher rates on longer-term CDs while still having access to some liquidity through shorter-term CDs. While this approach does not allow for additional deposits specifically to individual CDs, it permits the reinvestment of matured funds into new CDs, thereby enhancing potential earnings while maintaining liquidity.

It’s also prudent to consider the implications of additional deposits on the overall investment strategy. Regular contributions can be more effectively executed in a high-yield savings account or through systematic investment plans that provide more growth potential than traditional CDs. CDs are an excellent option for those looking for capital preservation rather than aggressive growth. However, juxtaposing their rigidity with the opportunities available through other investment avenues may be beneficial for a well-rounded financial portfolio.

Tax considerations should not be overlooked either. Interest earned on CDs is subject to federal income tax, and, in some cases, state and local taxes. As such, understanding how additional deposits impact your tax liabilities is crucial for holistic financial planning. It’s wise to consult a tax professional, especially if you plan to make regular contributions with an eye on minimizing tax impacts.

Another aspect to consider is the concept of early withdrawal penalties. If you add to a CD and later withdraw funds before maturity, it can result in significant penalties, potentially negating the benefits of the additional interest earned. Thus, it’s essential to maintain a keen awareness of the terms associated with any CD product you opt for, particularly concerning withdrawals.

In summary, while standard CDs present limitations regarding additional contributions, variations such as add-on CDs and bump-up CDs introduce innovative alternatives that allow savers more flexibility. The potential for incremental savings and the dynamism of financial strategies like CD ladders create pathways to optimize savings. Whether you are a novice saver or a seasoned investor, understanding these nuances can greatly impact your financial future.

Overall, exploring various types of CDs and understanding the unique attributes and limitations of each can empower savers to make informed decisions that align with their financial goals. Whether it’s maximizing interest or ensuring the availability of funds when needed, weighing your options thoughtfully is a crucial step in effective financial planning.