Imagine navigating through a complex labyrinth—each turn and twist representing financial decisions that could affect your future. One of the more intricate paths in this labyrinth is the journey of converting an annuity into a Roth IRA. Like any labyrinth, the process can feel daunting, yet with the right understanding, you can traverse it confidently.

To begin, it’s essential to grasp the fundamental differences between an annuity and a Roth IRA. An annuity is akin to a life vest in choppy financial waters, offering a steady influx of income during retirement. In contrast, a Roth IRA is a treasure chest, accumulating value over the years without the burden of taxes during withdrawals in retirement. While both serve as anchors for financial security, their structures are inherently distinct.

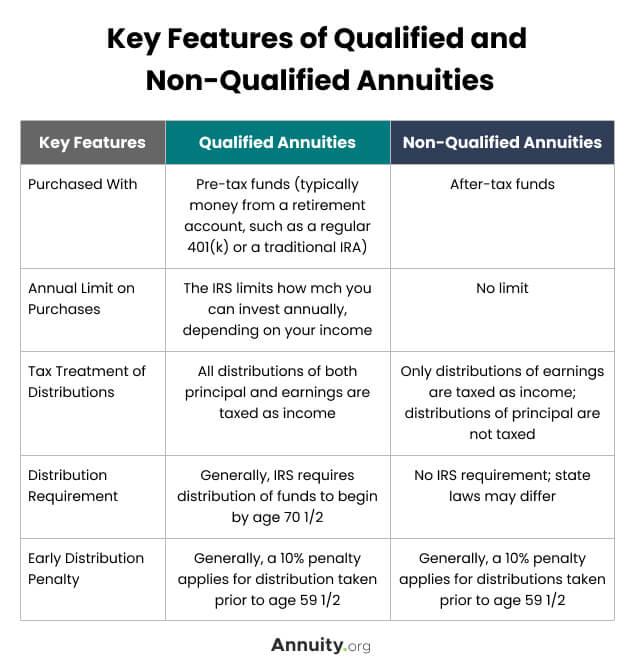

Now, let us discuss the feasibility of converting an annuity to a Roth IRA. The initial consideration is understanding the type of annuity you possess. If your annuity is “qualified,” it means that it was funded with pre-tax dollars and is subject to tax upon withdrawal. On the other hand, a “non-qualified” annuity holds contributions made with after-tax dollars. This distinction is pivotal when contemplating a transition to a Roth IRA, as it will determine the tax implications you must navigate.

For those with a qualified annuity, the transformation to a Roth IRA is not as straightforward as flipping a switch. In fact, you must first undergo a process known as a “taxable event.” This means that upon converting your annuity into a Roth IRA, you are required to pay income taxes on the amount you convert—think of it as extracting treasure from the depths of the ocean; it could come with heavy fees, especially if significant sums are involved.

Consider the timing of this conversion carefully. A well-thought-out strategy can mitigate the tax burden. By converting smaller amounts over several years, you can potentially dodge higher tax brackets. This gradual approach resembles sipping a fine wine rather than gulping it down all at once—enjoying each moment without overwhelming your senses.

Now, if you own a non-qualified annuity, converting it to a Roth IRA might be somewhat more palatable. With a non-qualified annuity, any distributions or conversions are taxed only on the earnings, not on the principal. This translates to lower tax implications during the conversion phase, making it akin to unveiling a hidden cache of jewels rather than an arduous mining operation.

Another essential aspect to ponder is the benefits of a Roth IRA. Unlike traditional retirement accounts, a Roth IRA allows your investments to grow tax-free. In retirement, you can withdraw funds without any tax. Imagine planting a seed that flourishes into a robust tree; you get to harvest the fruit without having to yield any to the taxman. The freedom this offers is one of the most alluring features of all, granting you the liberty to enjoy your hard-earned wealth fully.

As you ponder over this conversion, bear in mind the potential repercussions this decision may have on your future financial exposure. For example, if you are nearing retirement, the immediate tax impact may discourage you. Alternatively, if you are at a younger age with significant time left until retirement, the conversion may provide exponential growth due to the compounding effect of your investments over decades.

Perhaps one of the most fascinating elements of converting an annuity to a Roth IRA is the concept of estate planning. The Roth IRA can be a compelling tool for passing wealth to the next generation. As heirs, beneficiaries can inherit the account, allowing them to withdraw funds without incurring taxes. This feature positions the Roth IRA as a powerful strategic tool for long-term wealth preservation, much like a well-crafted family heirloom passed down through generations.

Still, it’s vital to tread carefully. Before embarking on this financial journey, assess your overall financial picture and long-term objectives. Engaging with a financial advisor can provide valuable insight tailored to your unique circumstances. They can help you chart a course that aligns with your goals while minimizing potential pitfalls, guiding you through the metaphorical maze with expertise and foresight.

Ultimately, the decision to convert an annuity to a Roth IRA requires thorough understanding and strategic planning. It is not merely a transaction but a step toward sculpting your financial future. Just as an artist shapes their canvas with thoughtful strokes, so too must you consider your financial choices with intent and purpose. Whether you emerge with the security of retirement income or the freedom of tax-free growth, the choice lies in your hands.

The labyrinth of financial decisions can be intricate, but with informed guidance, you can navigate your way through. Converting your annuity into a Roth IRA may provide you with a beacon of light. Embrace the possibilities and continue your journey toward a secure and enriching financial future.