Have you ever pondered the intriguing question: Can you make a Qualified Charitable Distribution (QCD) to a Donor Advised Fund (DAF)? It sounds rather straightforward, yet the complexities surrounding this philanthropic avenue can be as labyrinthine as a dense forest. For those aiming to maximize their charitable impact while enjoying tax benefits, this question is not only relevant but crucial. Let’s unravel this conundrum and explore the nuances of QCDs and DAFs, equipping you with the insights necessary to navigate this philanthropic landscape.

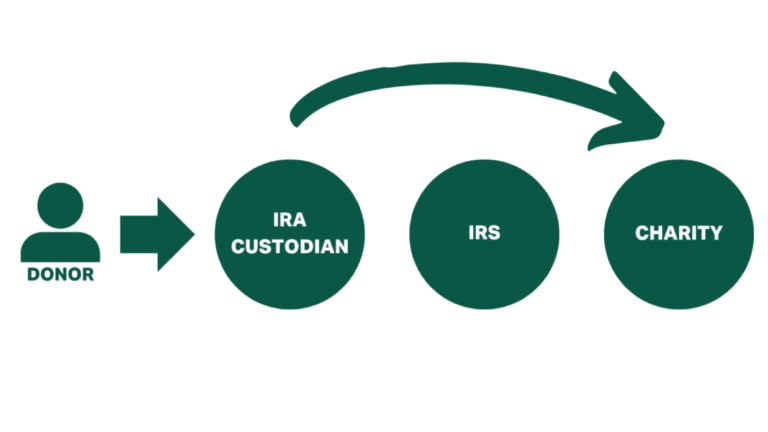

To start, let’s define our key players. A Qualified Charitable Distribution is a donation made directly from an individual’s Individual Retirement Account (IRA) to a qualified charity. This financial maneuver becomes particularly appealing for individuals aged 70½ or older, as it allows them to satisfy their required minimum distribution (RMD) without increasing their taxable income. Meanwhile, a Donor Advised Fund serves as a philanthropic vehicle, allowing individuals to contribute assets, receive an immediate tax deduction, and recommend grants over time to IRS-qualified charities.

Now, let’s lay the groundwork: upon reaching the esteemed age of 70½, you might find your mailbox inundated with forms and reminders about RMDs. But what if you could bypass the tax implications associated with those withdrawals? That’s where QCDs come into play. However, when contemplating a donation to a DAF, one might wonder: does this path lead to the same radiant tax benefits?

Herein lies our challenge. While individual contributions from IRAs can be directed to charities, the IRS clearly enunciates that QCDs must go to qualified charitable organizations, not intermediary funds such as DAFs. This is where the plot thickens. The IRS stipulates that QCDs must be directed to entities that act as charitable recipients, and unfortunately, a DAF does not fit this definition. Rather, it is a mechanism to facilitate ongoing charitable giving, making it an intriguing yet ultimately incompatible recipient for QCDs.

This determination can leave many potential benefactors disheartened, especially as they weigh their options for making impactful contributions. However, it’s essential to remember that understanding these regulations opens doors to alternative strategies that can still align with one’s charitable goals while optimizing tax benefits.

Instead of directing QCDs to a DAF, consider other avenues where your charitable heart can flourish. For instance, you might choose to support a specific charity that aligns closely with your passions. This approach not only allows your contributions to make an immediate impact but also circumvents the bureaucratic processes often associated with donor advised funds.

However, suppose your desire to support multiple charities remains steadfast and unwavering. In that case, establishing a separate DAF with contributions from your taxable income, rather than through a QCD, becomes a viable strategy. By doing so, you can enjoy the benefits of creating a foundational fund while continuing to recommend distributions to various charities over time.

In navigating this complex landscape, consider your overall philanthropic strategy. Are you focused primarily on immediate tax benefits, or is your goal to foster a legacy of giving? By answering this pivotal question, you can better align your financial decisions with your charitable aspirations.

Additionally, let’s delve deeper into the mechanics of leveraging tax benefits in charitable giving. For those keen on maximizing their financial efficacy, understanding the implications of tax deductions can be a powerful tool. Contributions to a DAF are eligible for charitable deductions in the year they are made, up to certain limits based on adjusted gross income. This allows you to potentially offset higher-income years, taking full advantage of the tax benefits available to you.

Furthermore, many patrons of DAFs appreciate the freedom these funds offer in terms of grant-making. You remain in control, dictating how your contributions can ripple through the charitable ecosystem over time. This approach provides a dynamic, engaging way to cultivate relationships with various charities, thereby enriching your philanthropic journey.

This doesn’t mean that the QCD route lacks merit; indeed, it serves as an invaluable approach for those with traditional IRAs seeking tax mitigation strategies. By directly distributing funds to organizations of your choosing via a QCD, you can delight in the double benefit of philanthropy coupled with tax efficiency. Just remember, this path is not conducive to the use of Donor Advised Funds.

As we reflect on the overall landscape of charitable distributions and the question of QCDs versus DAFs, it becomes increasingly clear that knowledge is power. Navigating this terrain necessitates a holistic understanding of the financial implications of your choices. Whether you opt for the direct route of QCDs or the flexible nature of a DAF, the key takeaway is the opportunity for you to create a significant impact through your charitable giving.

In summary, while the answer to our original question is a resounding “no,” the abundance of alternative strategies available for achieving your philanthropic objectives ensures that your journey need not deter. Embrace the nuances of IRS regulations, explore diverse charitable avenues, and wield your resources with intention. After all, in the grand tapestry of charity, every thread matters, and your contributions can weave transformative narratives for communities far and wide.