When it comes to managing debt, whether as an individual or a business, have you ever wondered what alternative paths are available when traditional bankruptcy feels too daunting or perhaps even unnecessary? In California, one intriguing option is the Assignment for the Benefit of Creditors (ABC). This alternative doesn’t just serve as a safety net; it might be the lifeline that leads you or your organization toward a fresh start. Delving into the complexities of ABC will illuminate its potential advantages, challenges, and the fundamental processes involved.

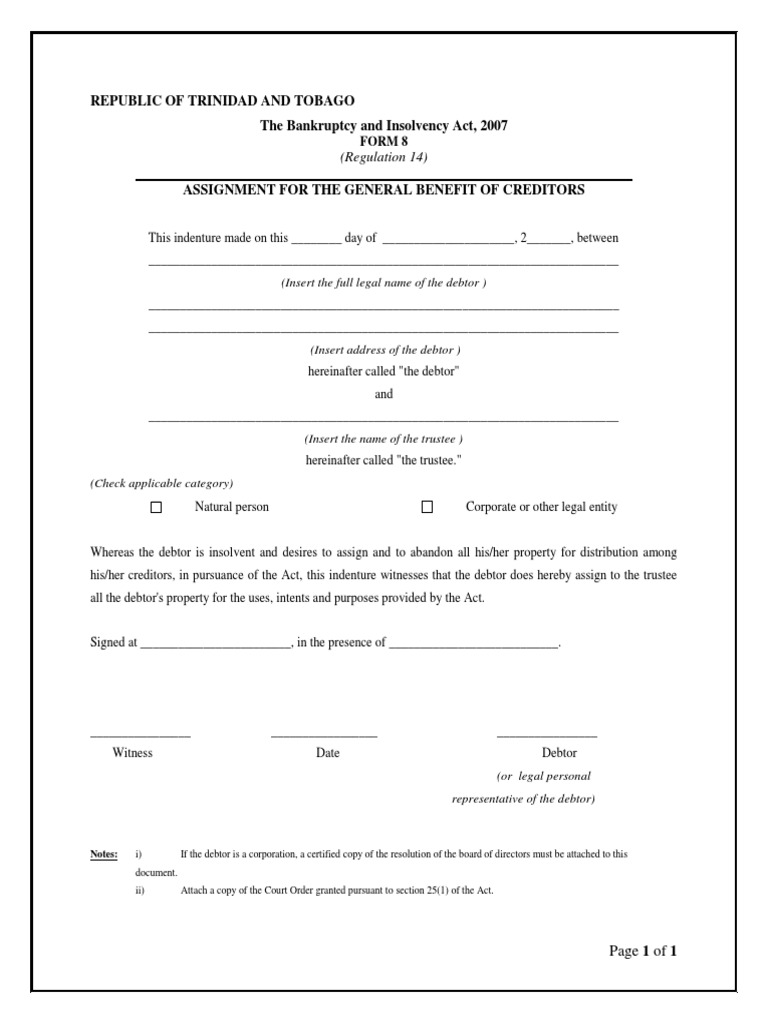

At its core, an Assignment for the Benefit of Creditors allows a financially distressed individual or business to transfer their assets to a third party, typically referred to as an assignee. The assignee then manages the liquidation of these assets in order to repay creditors. But why is this approach gaining traction in the financial landscape of California? The answer lies in its flexibility and the potential for a more efficient resolution compared to formal bankruptcy procedures.

So, let’s embark on a deeper exploration of ABC. What makes it a viable solution for creditors and debtors alike? First, consider that the process is often significantly less onerous than filing for bankruptcy. The procedural requirements are streamlined, which can result in lower administrative costs. This is beneficial for both sides; creditors may recover their debts more swiftly, while debtors can avoid the exhaustive demands of bankruptcy court.

To fully appreciate the intricacies of ABC, we must dissect the procedure itself. When a debtor realizes they can no longer meet their financial obligations, they may initiate an ABC by formally assigning their assets to a trusted assignee. This person or entity is responsible for overseeing the sale of these assets and distributing the proceeds to creditors in a manner that adheres to legal stipulations. But hold on a moment! Here’s a challenge for you: can you imagine the complexities involved in ensuring fairness among competing creditors? This is where the assignee’s role becomes crucial.

Unlike a bankruptcy trustee whose responsibilities are dictated by strict federal laws, assignees operate under state law, which can allow for a more customized approach. For instance, consider the ability of the assignee to negotiate settlements with creditors. This flexibility can lead to creative solutions that sidestep the cumbersome bureaucracy often associated with bankruptcy. However, this raises the question: are all creditors treated equitably in this more informal setting?

Understanding the rights of creditors during an ABC process is fundamental. Creditors must be notified of the assignment, and they typically have the opportunity to file their claims against the debtor’s assets. However, the informal nature of this process can sometimes lead to disputes about priority—certain creditors may feel they have a stronger claim due to the timing of their loans or other agreements. Addressing these potential conflicts proactively is essential to maintaining a productive assignment process.

Now, let’s shift our focus to the benefits that can be derived from an Assignment for the Benefit of Creditors. One of the standout advantages is the preservation of business operations. Unlike bankruptcy, which can often lead to significant disruptions, ABCs can facilitate a smoother transition during financially tumultuous times. Businesses can often continue operations while the asset liquidation proceeds, which can, in turn, maximize the recovery amounts received by creditors.

On the flip side, while ABCs present numerous advantages, there are certain drawbacks that should not be glossed over. One primary concern is that the assignment process may set unfavorable precedents for future creditor-debtor negotiations. Creditors unfamiliar with the assignment process may also feel bewildered and unprotected, particularly if they perceive themselves to be last in line when it comes to asset distribution.

Moreover, the effectiveness of an ABC hinges significantly on the integrity and efficiency of the assignee. The skill level and experience of this individual or entity can greatly influence the outcome of the assignment. If you’re a debtor considering this route, you might wonder: how do you choose a trustworthy assignee? Thorough vetting and due diligence are imperative. After all, this professional will essentially hold the keys to your financial future—choosing wisely is paramount.

Additionally, it is prudent to consider the tax implications associated with an ABC. Debt forgiveness and the liquidation of assets can have unpredictable consequences on one’s tax liability. Before embarking on this journey, consulting with a qualified tax professional can help illuminate any potential pitfalls that may arise.

As we explore the landscape of debtor solutions, the Assignment for the Benefit of Creditors certainly merits consideration. It serves as a beacon for those caught in the web of financial distress, offering a pathway that can lead to recovery with dignity rather than shame. Ultimately, should you find yourself in a precarious financial predicament, weighing the pros and cons of ABC versus bankruptcy could lead to the right solution tailored to your unique circumstances. Are you ready to engage in a discussion that might very well transform your financial future?