As the lines between personal and professional spaces continue to blur, the home office has evolved into more than just a quiet corner for work. It’s transformed into a pivotal aspect of many entrepreneurs’ lives. Amidst the allure of pajama-clad productivity, an intriguing question arises: Can I charge my business rent for my home office? The answer involves navigating the labyrinth of tax regulations while embracing the possibilities that come with it.

To begin, let’s delve into the concept of rent and its relevance in a home office context. When talking about charging rent to your business, it’s important to comprehend that this arrangement is not simply a whimsical economic decision. The Internal Revenue Service (IRS) has specific guidelines that influence how you can reasonably allocate costs associated with your home office. The distinction lies in understanding the parameters of the home office deduction and how it interacts with potential rental income.

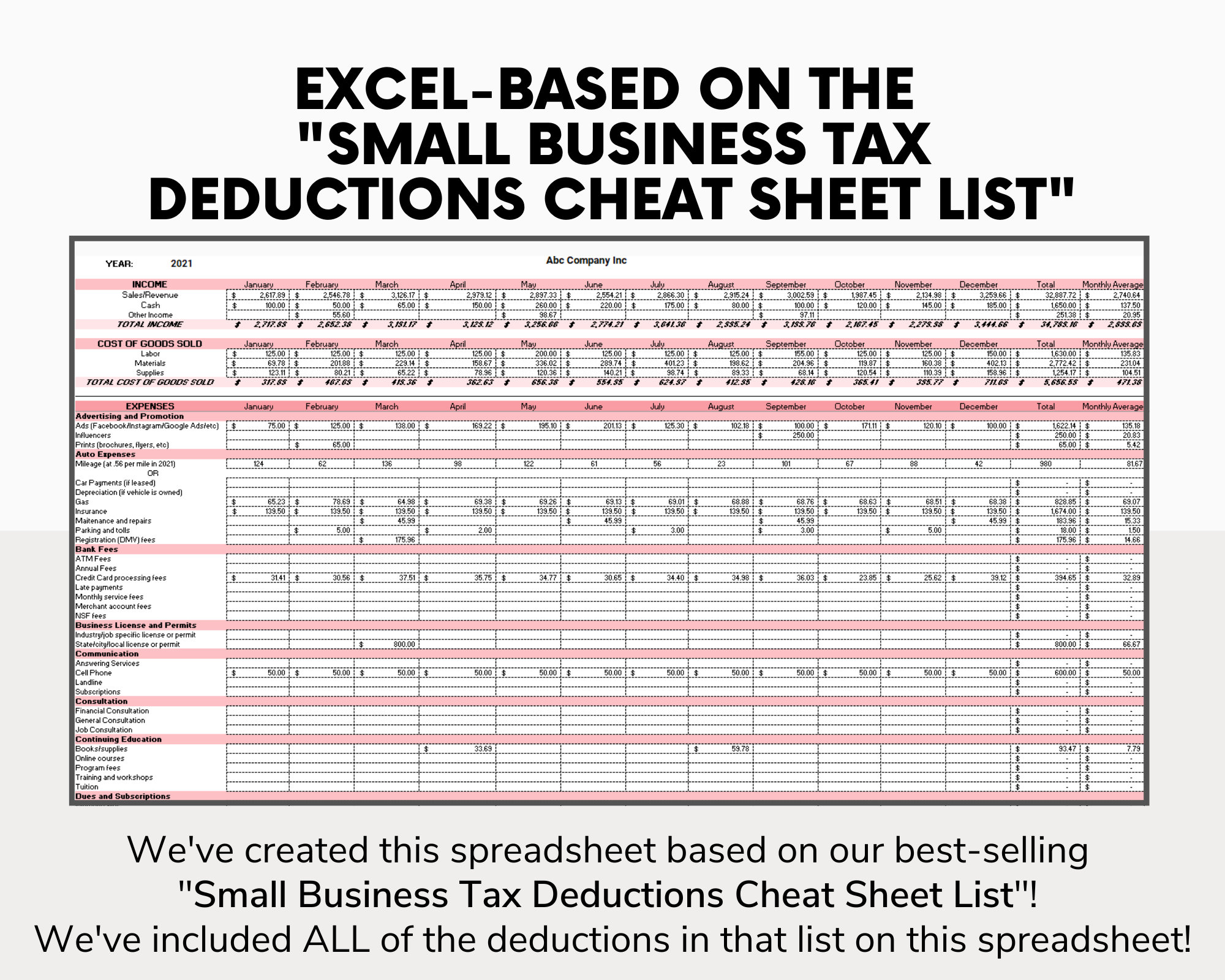

Often, individuals who operate from home overlook the financial implications of their workspace. However, establishing a dedicated office area can position you to benefit from deductions. These deductions can encompass a range of expenses: utilities, internet, and maintenance, among others. But, when you consider charging rent to your business, you step into a more intricate domain of taxation and financial management. Are you ready for that exploration?

First things first, let’s wrap our heads around what qualifies as a home office. The IRS stipulates two primary criteria: your office space must be your principal place of business or a space used regularly and exclusively for business purposes. This means that mixing laundry and client consultations in the same room may not suffice. Exclusivity is key, and therein lies the challenge—how to carve out an adequate space that meets these strict definitions.

Next, let’s examine the mechanics of charging rent. If you are a sole proprietor, you must ensure that you are operating a business structure that permits rental fee transactions. As large organizations often have a separate entity for their real estate, smaller operations may need to document these transactions carefully to ensure compliance with IRS regulations. This brings forth a pivotal consideration: Would charging rent complicate your financial reporting in a way that outweighs potential deductions?

For those who pursue this path, there are formalities to be observed. It is crucial to set a fair market rent price and create a rental agreement between you and your business. A well-drafted contract not only solidifies the legitimacy of the transaction but also aids in substantiating deductions should the IRS come knocking. Remember, the IRS operates on consistency—failures in documentation or significant discrepancies could lead to an audit that may have you gritting your teeth.

However, the tax benefits can be enticing. By charging rent, you may be able to shift some of your personal expenses to your business. This can result in a favorable tax scenario by minimizing your overall taxable income. Rent payments could compensate for part of your mortgage or lease payments, thus allowing you to strategically lessen your financial burden. But be wary: an overestimation of shared space can lead to complications. The IRS will look closely if they suspect any manipulation in your deductions.

Let’s explore different business structures. If you operate as an LLC or corporation, the rental arrangement may also differ. Some owners find that certain structures offer more flexibility in this regard. Always consult your tax advisor before committing to a course of action; tax code can be intricate and fraught with nuances that differ from state to state.

Another query arises: Are there additional repercussions from charging rent? Could it inadvertently lead to higher taxes? The intention behind these financial maneuvers is vital. Charging rent shouldn’t be an exercise in inflated expenses to create an illusion of reduced profits. Transparency is essential, and every line item in your budget should reflect veracity in your business dealings.

Yet, even as you swim through these waters, the opportunity for smart financial management emerges. The dialogue surrounding home office deductions and the implications of charging rent highlights a broader issue—the necessity for diligent record-keeping. The paperwork required to substantiate every deduction is as cumbersome as it is crucial. Each utility bill, every maintenance expense, and detailed notes on usage patterns contribute to a robust case for your claims.

In a world where entrepreneurship wears many hats, finding ways to utilize your home as a functional workspace can be liberating. It encourages creativity while enhancing productivity, but the journey demands prudence. Questions abound—what are your long-term goals? How do your current approaches align with your future aspirations? The financial mechanics of a rented home office may seem burdensome, yet they can be ingeniously harnessed for success.

Ultimately, the topic of charging rent for your home office provokes a blend of curiosity and caution. It opens a door to opportunity but also invites a wealth of complexity. As you consider whether a rental arrangement is right for you, weigh the benefits against the responsibilities. Is the potential reward worth the gambit? In the end, undertaking a careful assessment and seeking professional advice could safeguard your financial future while allowing your business to flourish.