In the vast and complex world of personal finance, understanding how hourly wages translate into annual incomes is a question that often lurks in the shadows of our consciousness. For many individuals wrestling with the implications of their paychecks, the conversion from an hourly wage to annual income represents more than mere arithmetic; it embodies aspirations, dreams, and the reality of living day by day. Today, let’s delve into what it means to earn $23.08 an hour and how that translates to a yearly income.

First, let’s set the stage. Earning $23.08 an hour positions an individual well above the federal minimum wage. In some parts of the country, this figure provides a sense of security — a stepping stone towards greater financial stability. To comprehensively understand the implications of this hourly rate, we must first consider the annual figure that arises from such a wage. Assuming a full-time position of 40 hours a week, with 52 weeks in a year, the straightforward calculation is as follows:

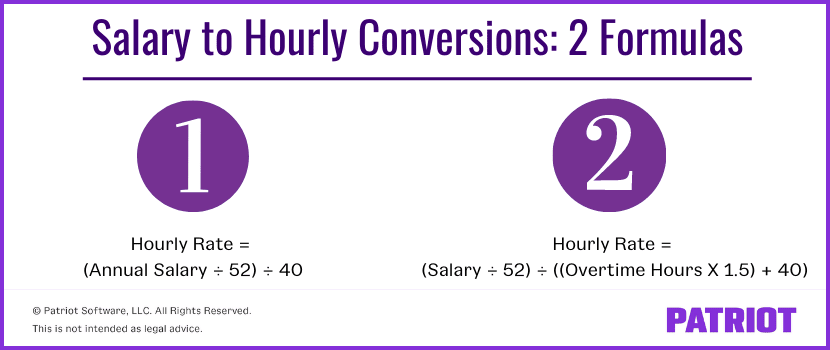

Hourly Wage × Hours per Week × Weeks per Year = Annual Income

Therefore, when we execute this calculation, $23.08 multiplied by 40, and then multiplied by 52, results in:

$23.08 × 40 hours/week × 52 weeks/year = $48,000.00 annually.

This figure is telling. For an individual whose income hovers around $48,000, a myriad of financial realities unfolds. With this income, one can adhere to the modern American lifestyle, which often includes rent or mortgage payments, car expenses, food, healthcare, and perhaps even elements of leisure and entertainment. But let’s pause here; earning $48,000 annually raises various questions about the socioeconomic landscape that shapes everyday experiences.

Imagine the single parent working tirelessly to provide for their children. At $23.08 an hour, they may have enough to provide basic necessities but struggle with the rising costs of living, especially in urban environments where rent and childcare can consume a substantial portion of income. The seemingly nominal pay becomes an anchor that ties them to their geographical location, affecting lifestyle choices and long-term aspirations.

Conversely, consider the recent college graduate stepping into the workforce with a starting salary around $48,000. For them, this wage represents opportunity. It is the launchpad from which they can invest in their future — setting aside funds for a 401(k), establishing an emergency fund, or even purchasing a first home. There’s a palpable dichotomy in how $23.08 an hour affects different people, revealing not just the versatility of income but also the deeper societal structures that govern financial stability.

Now, let’s not overlook the implications of taxes. The figure of $48,000 is gross income; the net income after taxes will be different. Depending on tax brackets, filing status, and potential deductions, one’s take-home pay could vary significantly. This reality can lead to varying perceptions of financial well-being among people earning the same hourly wage. Knowledge of tax obligations becomes vital for anyone, as understanding one’s net income can profoundly shape spending, saving, and investing behaviors.

As we brood over these financial implications, it’s essential to consider benefits and other compensations that might accompany an hourly wage. Health insurance, retirement contributions, bonuses, and paid time off can significantly alter one’s comprehensive understanding of compensation. Many companies utilize hourly rates as a base but enhance employee experience through assorted employee benefits, amplifying the financial equation.

For those on an hourly wage like $23.08, the concept of overtime comes into play. If an employee works beyond the typical 40 hours a week, they are usually compensated at a higher rate — often time and a half. This can further elevate annual income, providing additional financial leeway. As such, those who can secure overtime hours may find their yearly earnings pleasantly inflated. This invites a discussion about work-life balance, as the lure of additional income might tempt workers to prioritize hours worked over personal time.

Yet, amidst these calculations and considerations lies a deeper inquiry into lifestyle choices. Understanding what $23.08 an hour translates into on an annual scale can become a catalyst for decision-making. For example, the choice to live in a particular region or to navigate various debts is influenced by this income figure. Each choice is interconnected; one decision often reverberates through others, illustrating the complexity of financial management.

As we draw our discussion to a close, it becomes apparent that $23.08 an hour is more than just a number. It serves as a cornerstone for understanding one’s financial standing within a broader societal context. Whether one is struggling to make ends meet, finding comfort in a steady income, or recognizing the potential for growth, the intricacies of hourly versus annual income bear significant weight. Thus, the voyage of understanding personal finance becomes a compelling journey meriting deeper exploration. Each calculation opens doors to fundamental questions about value, priorities, and aspirations, making the conversation about money one of the most vital discussions we engage in for our future well-being.