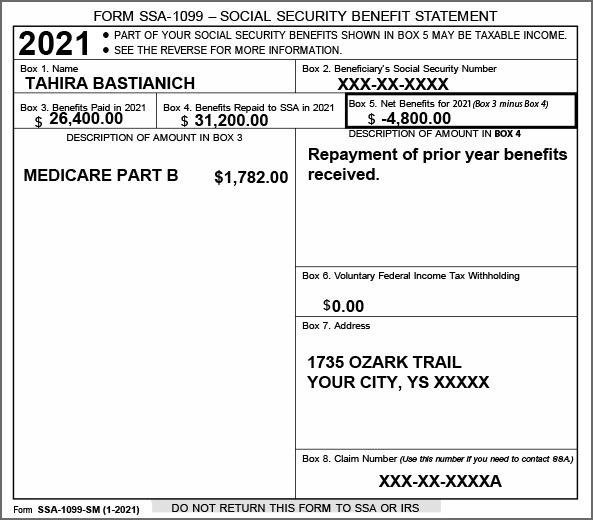

When it comes to handling finances, particularly dealing with taxes, many individuals find themselves wrestling with a plethora of questions. One such query that surfaces annually is the treatment of attorney fees, specifically regarding the SSA-1099 form. The SSA-1099 is an essential document issued by the Social Security Administration, detailing the amount of Social Security benefits received during the tax year. However, the complexities arise when individuals consider whether legal fees associated with these benefits can be deducted from their taxable income in 2023. In this article, we will delve deeply into the various facets of this topic, exploring the nuances of deductibility concerning attorney fees.

Initially, it is crucial to understand what attorney fees encompass in the context of Social Security benefits. Legal representation may become necessary for a variety of reasons. Individuals often seek the assistance of a legal professional when they encounter challenges navigating the sometimes convoluted processes of the Social Security Administration. In instances where disputes arise—such as denials of claims or difficulties in obtaining benefits—having proficient legal guidance can make a significant difference. However, the question persists: are such expenses deductible?

For the 2023 tax year, the deductibility of attorney fees rests on specific criteria outlined by the Internal Revenue Service (IRS). Typically, legal fees are categorized within the broader classification of miscellaneous itemized deductions. Historically, these deductions were subject to limitation, particularly post the Tax Cuts and Jobs Act (TCJA), which suspended many itemized deductions from 2018 through 2025. Despite these restrictions, certain legal fees can still be deductible if they fulfill particular conditions.

A pivotal factor in determining whether attorney fees are deductible is the purpose of the legal representation. If the fees are incurred for the purpose of recovering taxable income—or in this case, Social Security benefits—they may be eligible for deduction. For instance, if an attorney is hired specifically to address complications with receiving Social Security disability benefits, the associated fees might qualify for deduction since they are directly linked to the recovery of income.

However, there exists another dimension to consider: the nature of the SSA-1099 form itself. This form essentially signifies that you have received Social Security benefits, which are generally not considered taxable income at the level where specific provisions for deductions can apply. Therefore, understanding the implications of this relationship is paramount. Additionally, one needs to be aware of the thresholds that determine the taxable portion of these benefits based on overall income.

Given the complexity surrounding the IRS regulations and the individual circumstances that can significantly vary, it is advisable for taxpayers to meticulously document all related attorney fees. Meticulous records not only strengthen your position should the IRS question the deductibility, but they also foster an organized approach to financial management. Keep invoices, receipts, and categorical notes pertaining to the services rendered, ensuring everything correlates with your SSA-1099 documentation.

Moreover, there are various avenues in which attorney fees can manifest, from upfront retainers to contingent fees that could have implications on your overall tax liabilities. Should you procure benefits retroactively due to the involvement of an attorney, understanding how those fees interact with the total amount received is crucial. For example, if the attorney takes a percentage of back benefits awarded as a result of their legal representation, this structure can further entangle the matter of deductibility.

Additionally, it is imperative to consider the distinction between personal and business tax implications. Individuals characterizing themselves as self-employed, and who involve legal fees in the earning of income from self-employment, may find that those fees take on a different complexion altogether—often allowing the fees to be deducted as a business expense rather than solely tied to personal deductions. Evaluating one’s status can lead to beneficial outcomes, but it necessitates an astute understanding of IRS guidelines coupled with personal circumstances.

A common pitfall many taxpayers encounter is the dependence on general advice or anecdotal evidence from peers. However, tax law is intricate, with myriad variables that can sway determinations of deductibility. Engaging a knowledgeable tax professional can provide insights tailored to your unique situation, facilitating a clearer path through the tax landscape. They can help decipher the fine print of the IRS regulations, ensuring you are fully informed of your rights regarding legal expense deductions relative to your SSA-1099.

As the 2023 tax season approaches, many individuals will be faced with submitting their SSA-1099 forms alongside their tax returns. For those who have engaged lawyers to assist with Social Security-related issues, understanding the rules governing attorney fees and their deductibility can yield significant financial advantages. Being proactive and informed can aid in maximizing deductions, thereby potentially lessening overall tax liability.

To summarize, the landscape surrounding attorney fees as it pertains to the SSA-1099 form is marked by regulatory intricacies and individual circumstances. While some legal fees may qualify as deductions under specific circumstances, the overall approach must be grounded in thorough documentation and a clear understanding of IRS stipulations. As you prepare for the upcoming tax season, equip yourself with knowledge and seek professional advice to ensure your tax strategy is both compliant and advantageous.