Life insurance plays a pivotal role in ensuring financial security for your loved ones in the event of unforeseen circumstances. However, individuals with a history of cancer may harbor apprehensions over their eligibility for life insurance. One such concern that often arises is whether people who have battled thyroid cancer can procure life insurance. In this article, we will delve into this subject, illuminating the factors that insurance companies consider, the types of coverage available, and suggestions for enhancing your chances of obtaining a policy.

Understanding Thyroid Cancer

Thyroid cancer, although largely treatable, can cause anxiety regarding life insurance prospects. It occurs when abnormal cells in the thyroid gland grow uncontrollably. The four main types include papillary, follicular, medullary, and anaplastic, each varying in severity and treatment options. The prognosis for those diagnosed with thyroid cancer is typically favorable, particularly for the more common types, such as papillary and follicular. Nevertheless, the stage at diagnosis, treatment history, and recovery will significantly influence insurance underwriting decisions.

How Life Insurance Works

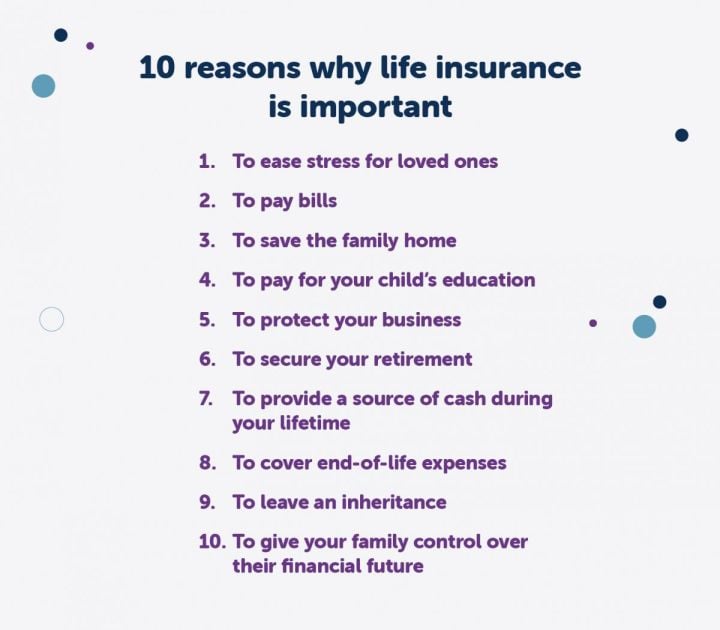

Life insurance is a risk management product that provides a monetary payout, known as the death benefit, to beneficiaries upon the policyholder’s demise. There are two primary categories: term life insurance, which covers a designated timeframe, and whole life insurance, which remains active throughout the insured’s lifetime, provided premiums are paid. Some insurers, conversely, offer universal life policies that afford flexibility in premium payments and death benefits.

Eligibility Criteria

When applying for life insurance, applicants undergo an underwriting process where insurers evaluate risk based on health history, age, lifestyle, and occupation. For individuals with a history of thyroid cancer, insurers will typically require comprehensive medical information, including:

- Type of thyroid cancer: The specific type diagnosed influences risk assessment.

- Stage at diagnosis: Early-stage cancers present less risk compared to advanced stages.

- Treatment history: Treatment protocols, such as surgery, radiation, or medication, and their outcomes are essential.

- Recurrence: A history of recurrent cancer may prompt insurers to impose stricter terms.

- Current health status: An evaluation of the applicant’s overall health, including follow-up care, is critical.

Impacts of Thyroid Cancer on Life Insurance Premiums

Those who have undergone treatment for thyroid cancer might face higher premiums compared to individuals without cancer-related health issues. Insurers often categorize applicants into different risk tiers: standard, preferred, and substandard. If a person is considered a substandard risk due to cancer history, they might witness elevated premiums or adjustments in policy structure.

Types of Life Insurance Available

Options for insurance policies are many, and understanding these can enhance your decision-making process:

- Term Life Insurance: This type is ideal for those requiring coverage for a particular period—often 10, 20, or 30 years. It’s generally more economical and provides a straightforward death benefit.

- Whole Life Insurance: In providing lifelong coverage, whole life insurance also includes a cash value component that grows over time. While pricier, it can serve as a financial investment.

- Guaranteed Issue Life Insurance: This policy is accessible for individuals who may not qualify for standard underwriting due to health issues. However, it often comes with lower coverage limits and higher premiums.

- Final Expense Insurance: Designed to cover funeral costs, this type of policy can be an excellent option for those concerned about leaving financial burdens for their families.

Steps to Improve Your Insurability

Enhancing your chances of securing life insurance post-thyroid cancer diagnosis involves several proactive measures:

- Wait after Treatment: If you have recently completed treatment, consider waiting a few years—typically three to five—before applying for insurance. This waiting period allows for a more stable health assessment.

- Regular Check-Ups: Regular visits with your healthcare provider ensure continuous monitoring and demonstrate a commitment to health, which can significantly favor your application.

- Maintain a Healthy Lifestyle: Focus on diet, exercise, and avoiding harmful habits like smoking to improve overall health, thereby enhancing insurability.

- Gather Medical Documentation: Employ organized documentation of your treatment history and recovery progress to present a strong application.

- Consult an Insurance Broker: Brokers who specialize in high-risk insurance can offer insights into suitable policies and help navigate the complexities of underwriting with a cancer history.

Addressing Common Myths

Many misconceptions exist surrounding life insurance and cancer. One popular myth is that having any cancer history precludes one from obtaining life insurance. However, while it may complicate the process, it’s not an insurmountable obstacle. Additionally, another misconception is the belief that only individuals in remission qualify for coverage. In reality, even those actively undergoing treatment may still explore options.

Conclusion

Acquiring life insurance after a thyroid cancer diagnosis certainly poses challenges, yet it is feasible. Understanding the complexities of the application process, the types of policies available, and steps to optimize your chances can demystify this journey. A proactive approach and awareness of common misconceptions can equip you with the necessary tools for securing a policy that offers peace of mind to you and your family. Ultimately, the goal is to ensure that financial difficulties do not compound the challenges arising from health issues, allowing you to focus on living life fully and freely.