In a world where every investment decision can feel like a high-stakes gamble, the question arises: How can we strategically allocate our assets in an increasingly low-yield environment? Today’s market brings forth challenges that can make even the most seasoned investors feel uneasy. With interest rates languishing at historic lows, traditional investment strategies may not yield the desired returns. So, how do we navigate this treacherous landscape and ensure our portfolios are not only fortified against volatility but are also designed for sustainable growth?

Before diving into the intricacies of low-yield and high-strategy asset allocation, let’s ponder an intriguing scenario. Imagine you’ve amassed a significant sum for retirement. You’ve diligently followed conventional wisdom—investing in bonds and blue-chip stocks. However, as you sift through your investment statements, the realization hits you: your returns resemble the sluggish pace of molasses. This is where the heart of the challenge lies!

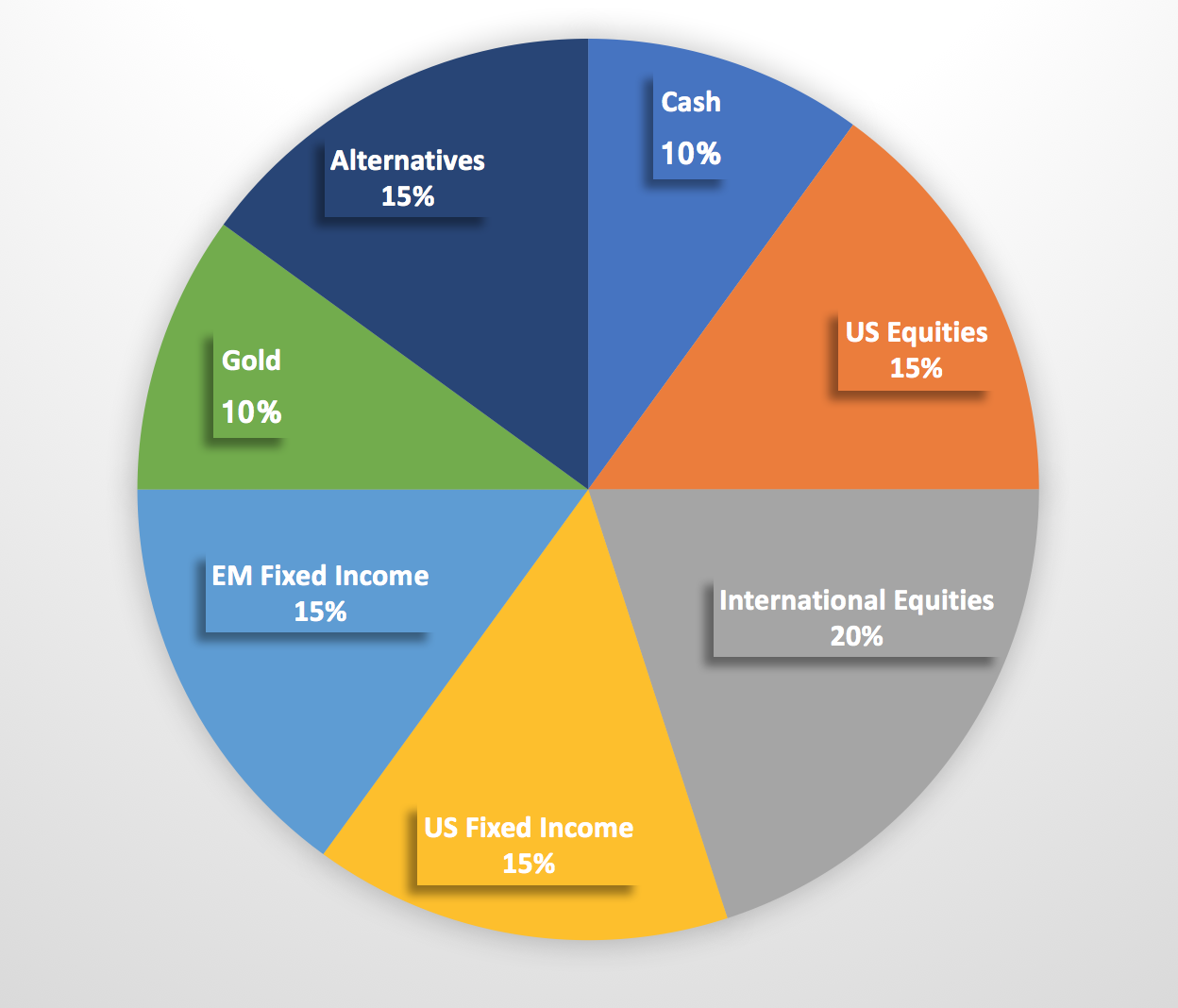

The first step in addressing the predicament is to redefine our understanding of asset allocation. It’s more than simply dividing assets among stocks, bonds, or real estate; it is an elaborate strategy that weaves together risk tolerance, investment horizon, and market conditions. In the face of low yields, a wider array of investment options should be explored. This involves a delicate balancing act where we aim to maximize returns while managing risk.

Growth-focused equity investments may seem an alluring alternative. Companies that demonstrate robust earnings potential can provide an edge in a low-yield environment. Look for sectors poised for expansion—technology, renewable energy, and healthcare innovations often represent fertile ground for investing. But here lies a conundrum: while growth stocks can potentially yield higher returns, they often come with increased volatility. The question becomes, how much risk are we willing to embrace in exchange for higher rewards?

To elegantly maneuver through these uncertainties, diversification emerges as a fundamental pillar. However, in a world where correlations between traditional asset classes are evolving, this tactic must be reexamined. Rather than clinging solely to the typical mix of stocks and bonds, consider broader asset categories. Real estate investment trusts (REITs), commodities, and even alternative assets like cryptocurrencies might fit into the paradigm of a diversified portfolio. Each offers unique growth opportunities that can cushion against downturns in more conventional avenues.

Moreover, staying informed and adaptive to market dynamics is key. Annual reviews of your portfolio cannot rely solely on historical performance. Instead, they should embrace future projections and world events that could impact market behavior. The post-pandemic landscape calls for a shift in asset allocation strategies, as global economies strive for recovery while navigating inflationary pressures and supply chain complexities.

As we acknowledge the role of macroeconomic factors, let’s discuss the allure of fixed-income investments, traditionally seen as the safe haven of portfolios. Bonds, especially in a landscape of rising interest rates, pose their set of challenges. With the Federal Reserve indicating intentions to tighten monetary policy, the value of many existing bonds may depreciate. The conundrum remains—how do we seek stability in bonds while pursuing yield?

One approach is to consider shorter-duration bonds or floating-rate notes that are less sensitive to interest rate shifts. This can reduce interest rate risk while still considering the current income needs. On the flip side, strategic bond ladders can offer a structured way to manage interest rate fluctuations while ensuring liquidity. Understanding the role of duration in fixed-income investments becomes paramount; it’s akin to steering a ship through tumultuous waters.

Additionally, alternatives such as private equity or hedge funds provide access to potential high-yield opportunities. Investing in these vehicles often demands a willingness to lock in capital for extended periods, but they can also yield returns that counterbalance the tepid growth elsewhere. Nevertheless, always weigh the fees, risks, and expected returns of these investments against traditional assets. They are not without their fair share of complexity.

In summary, crafting an asset allocation strategy in today’s market requires a bold yet deliberate approach. Embracing both traditional and alternative assets is essential to navigate the low-yield wilderness. Be vigilant—monitoring market trends and being ready to pivot is integral to successful investing. As we reiterate the challenges posed by low yields, the call to action remains: adapt, innovate, and diversify. Only then can we design portfolios that thrive not merely in surviving, but in flourishing amidst uncertainty.

So, let’s embrace this paradigm shift and ask ourselves, how can our unique decisions as informed investors lead us toward the proverbial pot of gold at the end of the investment rainbow? The challenge is real, but the possibilities are endless when we reimagine our asset allocation strategies in a world that is always evolving.