In the realm of financial management, understanding overhead reporting becomes a pivotal aspect for any organization striving for clarity in departmental contributions. Overhead, often deemed the indirect costs associated with running a business, includes expenditures such as rent, utilities, and administrative expenses that are not directly tied to a specific product or service. A departmental contribution to overhead report is an invaluable tool that provides insights into how different segments of a business contribute to, or burden, the overall financial health. This article delves into the nuances of overhead reporting, what readers can expect from such reports, and the implications for managerial decision-making.

To navigate the intricacies of overhead reporting, it’s essential to categorize the various types of overhead costs. These can generally be divided into three main categories: variable overhead, fixed overhead, and semi-variable overhead. Variable overhead costs fluctuate with production volumes and may include items like utility bills for manufacturing plants that vary based on machine usage. Conversely, fixed overhead remains stable regardless of production levels, encompassing expenses such as salaries of administrative personnel or rent for office space. Finally, semi-variable overhead costs possess characteristics of both variable and fixed costs, which can include elements like phone bills, where a basic charge exists independently of use, but variable rates apply based on the actual usage.

When viewed through the lens of departmental contributions, these costs can provide a quantitative measure that illustrates how well individual segments of the business manage their resource allocations. For instance, a manufacturing department may have high variable overhead but effectively manage to keep costs down during peak seasons. In contrast, an administrative department may present fixed overhead that appears excessive unless contextualized with performance metrics indicating productivity levels.

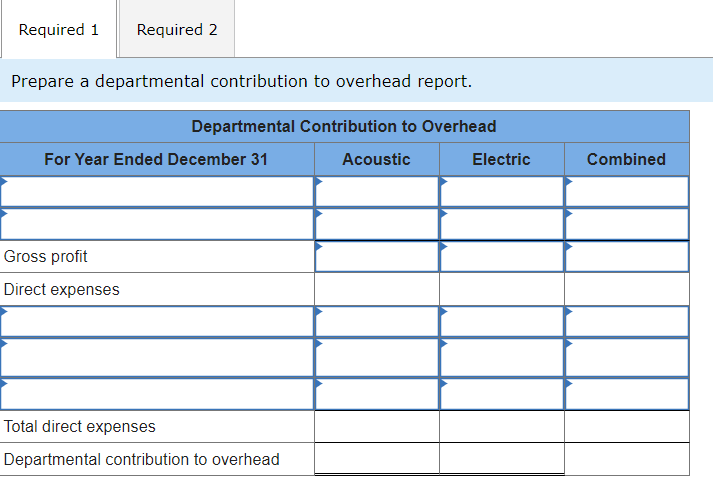

A departmental contribution to overhead report tends to include multiple components, each serving a distinct purpose. First, it provides an itemization of all departmental expenses, categorizing them based on the aforementioned overhead types. This granular breakdown not only clarifies where resources are being allocated but also helps in performance evaluation. Managers can pinpoint areas requiring attention; for instance, if a particular department consistently overspends on fixed overhead without yielding proportionate results, it signals a need for strategic reassessment.

Second, such reports typically feature calculations of departmental contributions, quantifying how much each department covers its share of overhead. This is often expressed as a percentage, allowing for straightforward comparisons across different areas of the organization. Departments operating at a deficit may necessitate immediate action to either curtail spending or enhance revenue streams. Understanding these dynamics is crucial for sustaining operational efficacy.

Nevertheless, the utility of overhead reporting transcends mere cost management. It acts as a catalyst for fostering a culture of accountability among departments. When departmental leaders recognize that their performance directly impacts the overall expenditure framework, they become more inclined to take ownership of their financial decisions. Consequently, the transparency engendered by overhead reporting paves the way for collaborative cost-control initiatives, encouraging inter-departmental dialogues aimed at optimizing resources.

Moreover, overhead reports can facilitate informed forecasting and budgeting processes. By analyzing historical data on overhead contributions, managers can make educated projections about future resource allocations. This strategic insight aids in avoiding potential budgetary pitfalls and ensures that funds are allocated to departments that exhibit the highest potential for return on investment. For instance, if a marketing department demonstrates a history of effectively controlling overhead costs while generating substantial revenue, future budgets may reflect increased investment in that area.

Furthermore, overhead reporting is not static; it evolves with the organization. The impact of emerging technologies and market trends can influence how departments allocate and report overhead. For example, a growing reliance on digital tools may reduce certain fixed overheads, leading to a reallocation of resources and prompting a reevaluation of departmental contributions. As organizations pivot to embrace digital transformation, the traditional methodologies of measuring overhead must adapt accordingly.

One must also consider the limitations inherent in overhead reporting. Misinterpretation of data can yield counterproductive outcomes. For example, excessive focus on cutting overhead may lead to diminished quality of service or product offerings. Additionally, the nature of indirect costs means that correlations can become obscured, making it challenging to draw precise conclusions regarding departmental efficiency. Thus, while the data from overhead reports can provide invaluable insight, they should be approached with a balanced and critical eye.

In conclusion, a departmental contribution to overhead report stands as an essential instrument for organizational health and profitability. By dissecting overhead costs into their composite elements, businesses can gain insights that go beyond mere numbers. Engaging in this analytical practice cultivates accountability, informs strategic decisions, and underlines the dynamic interplay between departmental performance and overall financial sustainability. As organizations strive for excellence in their respective industries, embracing the intricacies of overhead reporting will undoubtedly aid in devising effective strategies that align with long-term goals.