When one ventures into the world of partnerships, it often feels like setting sail on uncharted waters. A partnership, much like a ship, is often a blend of various minds, expertise, and resources. Each partner brings their unique talents, but when it comes to navigating the murky waters of taxation, understanding partnership payouts can become a daunting endeavor. Among the many questions that arise, one stands out prominently: Are distributions from a partnership taxable?

To dive deeply into this subject, it is crucial to first understand what a partnership is. Essentially, a partnership is an arrangement where two or more individuals manage and operate a business together, sharing its profits, losses, and responsibilities. This collaborative spirit makes partnerships an appealing choice for many entrepreneurs. However, as with any affluent treasure, the implications of taxation can be complex and multifaceted.

At the heart of this discussion is the distinction between distributions and income. In the realm of partnerships, distributions can be likened to the fruit borne of a laborious harvest. They represent the allocation of profits to partners based on their partnership agreement. But like a garden that yields its bounty, not all fruits are free from the vine’s ties. Understanding taxation on these distributions hinges largely on the partner’s basis in the partnership.

To expound on this metaphor, think of your partnership interest as a garden plot. When you invest into this plot—be it with capital, property, or labor—you establish what is known as your “basis.” This basis is akin to the soil quality; it determines how fertile your potential distributions can be. As a partner contributes to the partnership through their investments, their basis increases. Conversely, when they receive distributions, their basis shrinks.

Now, here’s where the intricacies of tax liability come into play. If a partner receives distributions that do not exceed their basis, these payouts are generally non-taxable. Picture it: you’ve cultivated a lush garden, and when harvest time finally arrives, you pluck the fruits of your labor. Tax-wise, because these distributions don’t surpass what you’ve put in, it’s like enjoying your home-grown tomatoes without a visit from the tax collector. However, should the distributions exceed the basis, the excess becomes taxable, much like a delightful surprise when your neighbor shares store-bought produce—but now the taxes fall upon your shoulders.

Additionally, it’s worth considering the types of income a partnership might generate. Partnerships can earn ordinary income, capital gains, or losses, each of which plays a different role in taxation. These outcomes can be as varied as a colorful bouquet, with each flower representing different tax implications. Ordinary income is subject to regular income tax rates, while capital gains can offer more favorable rates depending on the duration of asset holding. Partners generally report their share of these earnings on their personal tax returns, reflecting the partnership’s performance. This intricate dance of taxation is essential for both management and partners to comprehend fully.

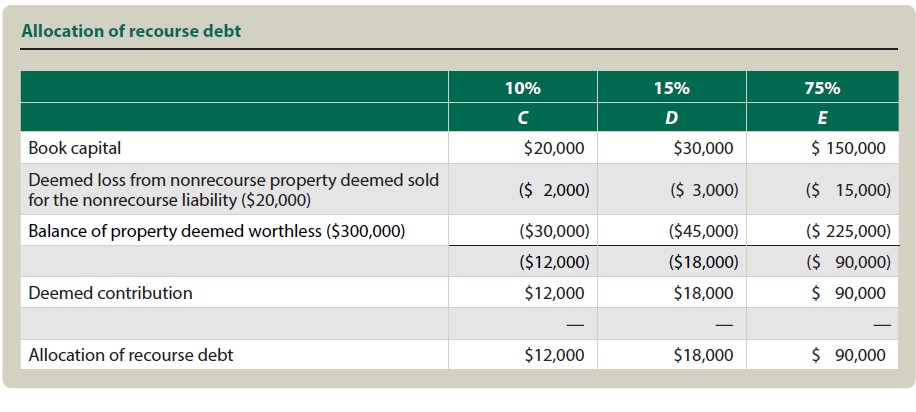

Partnerships, however, bring along an impressive array of other potential tax ramifications. For instance, recourse and nonrecourse debt can intricately entwine themselves within distributions. Recourse debt is akin to a partner personally guaranteeing a loan; should the partnership fail, the liability remains firmly tied to that partner’s shoulders. In contrast, nonrecourse debt allows lenders to claim only the partnership’s assets in the event of insolvency, offering some shield to the partners themselves. These classifications can influence how distributions to partners are treated for tax purposes.

Moreover, it’s paramount to address the issue of limits on deductions and losses. Certain limitations can prevent partners from utilizing losses to offset distributions or other sources of income fully. For instance, the passive activity rules restrict losses arising from passive investments—whether a partner is an active participant or a silent observer. It’s a paradox reminiscent of a beloved cafe that only serves their best coffee to those who place an order, while others gaze longingly from outside.

As partners contemplate getting into the intricate web of partnership distributions, a thorough understanding of tax liabilities can utterly transform future decisions. It is wise for partners to diligently document contributions and withdrawals, carving a transparent pathway toward tax compliance and strategic planning.

Furthermore, consulting with tax professionals can provide much-needed clarity. Navigating the tax landscape as a partner is not merely about understanding amounts but engaging with the broader implications of each distribution. Tax rules are as fluid and complex as the sea, changing with every tide. Therefore, continuous education and awareness are crucial to ensuring compliance while maximizing the benefits of partnership structures.

In conclusion, the world of partnership payouts is rich with opportunities and pitfalls alike. Understanding the tax implications—what is taxable and what is not—requires more than merely knowing the figures; it necessitates comprehending the broader context and framework within which these distributions occur. Like navigating through foggy waters, a clear understanding provides not just direction but also peace of mind, allowing partnerships to thrive and prosper within the realm of business. Take the time to engage with the complexities, and the returns can be as nourishing as the most bountiful harvest.