In an ever-changing economy, understanding your worth is more crucial than ever. You may have heard that $32.55 an hour is a potential hourly wage, but what does it truly mean for your annual income? The allure often lies in the simplicity of the number itself, but there’s far more when you peel back the layers. Let’s delve into the intricacies of this figure, uncovering the nuances that could shift your perspective on income and financial wellness.

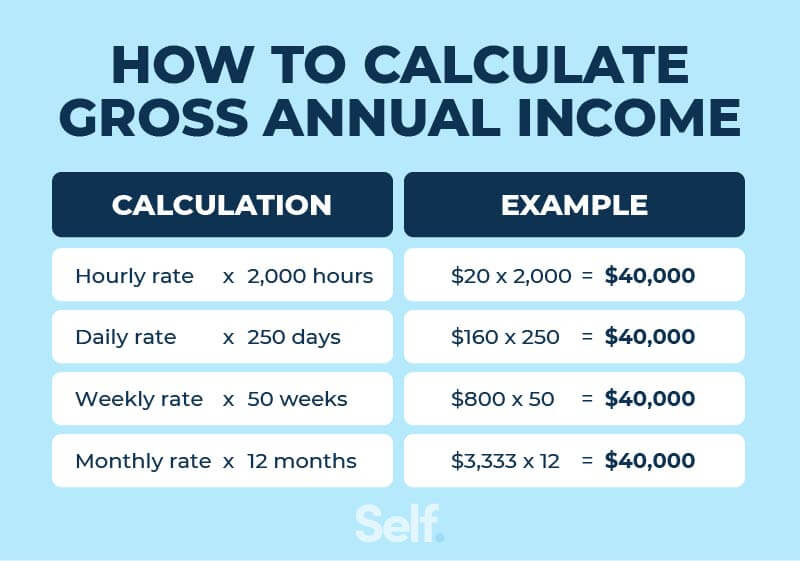

Imagine waking up each day, knowing that your work is not just a job, but a means to enhance your lifestyle, create opportunities, and fulfill your ambitions. Earning $32.55 an hour equates to a different world altogether when viewed through the lens of annual income. Assuming a standard full-time work schedule of 40 hours a week for 52 weeks, the mathematics quickly reveals an annual salary teetering around $67,704. This figure is more than a mere number; it’s a foundation upon which dreams are built and future plans meticulously designed.

However, before you conjure images of plush living and carefree spending, it’s essential to comprehend that annual income encompasses more than just a paycheck. The components include taxes, benefits, and sometimes unforeseen expenditures that may dramatically alter the residual income you take home. Grasping this concept is where the journey begins—to make informed decisions, cultivate financial literacy, and appreciate the strategic implications of your salary.

Let’s explore what this annual income means in practical terms. The first transformative concept is understanding the role of taxes. In the United States, taxes can consume a significant portion of your earnings, with federal, state, and possibly local taxes chipping away at your take-home pay. It’s prudent to calculate your net income using tax brackets, potentially reducing your earnings significantly from that appealing figure. For someone earning $67,704, this could mean a net income of approximately $50,000 or higher after deductions. Understanding these mechanics allows for strategic planning in budgeting and investments.

Next comes the topic of benefits—these are often the unsung heroes in the conversation about salary. Many employers will provide benefits such as health insurance, retirement contributions, and paid leave, which enhance your overall compensation package. In many cases, these benefits can represent thousands of dollars in value and should not be overlooked. Investing wisely in these opportunities ensures not only your present security but also nurtures your future.

With a clear comprehension of taxes and benefits, one can begin to assess the implications of the $32.55 hourly rate on lifestyle choices. Living on an annual income of around $67,704 affords various privileges. One can secure stable housing, maintain a reliable vehicle, and perhaps enjoy the occasional indulgence like dining out or travel. However, this wage also demands a certain level of responsibility; budgeting becomes paramount. Living beyond your means, no matter how tantalizing, can quickly lead to financial turmoil.

Moreover, this wage opens doors to investment opportunities. With prudent financial management, the ability to save and invest becomes feasible. Whether you’re considering real estate, stocks, or starting a small business, the accumulation of wealth is predicated on your financial decisions informed by your earnings. The sobering reality, though, is that without an aggressive approach to saving and planning, the income can dissipate as quickly as it arrives.

Furthermore, earning $32.55 per hour positions you strategically within the workforce. This wage reflects a middle-income lifestyle; you are well-positioned in the labor market with various job prospects. Understanding this value can empower you during negotiations for raises or new job offers. Perhaps more significantly, it compels a personal reflection on your career trajectory and whether this hourly rate is commensurate with your contributions and aspirations. Are you progressing in your industry? Are there skills you can acquire that will enhance your marketability?

Let’s take a detour into a more philosophical realm. Income—hourly or annual—should not be viewed in isolation. The correlation between money and happiness is a complex tapestry interwoven with personal values and life goals. At $32.55 an hour, one may discover a gratifying balance between work-life harmony and enough income to thrive without succumbing to financial strain. This realization can help align job satisfaction with income, creating a fulfilling professional life.

In conclusion, the intriguing exercise of dissecting what $32.55 an hour means extends far beyond mere arithmetic. It’s a comprehensive exploration of finances that highlights the essential role of taxes, benefits, and sound financial decision-making. It’s also an invitation to reflect on what you truly value in life—what does financial independence mean for you? As you navigate through your own career and financial landscape, remember that awareness of your worth can lead to deliberate choices that align with both your personal and financial aspirations. This newfound perspective may just be the catalyst needed to transform your understanding of salary into something much more significant—a powerful tool for achieving your dreams and securing your future.