Have you ever wondered if the hefty taxes levied on your W2 income could be mitigated by some clever financial maneuvering? What if I told you that there exists a strategy that might just lighten your tax burden? Enter cost segregation, a method that invites both property owners and tax planners to ponder the potential of offsetting W2 income through savvy asset management.

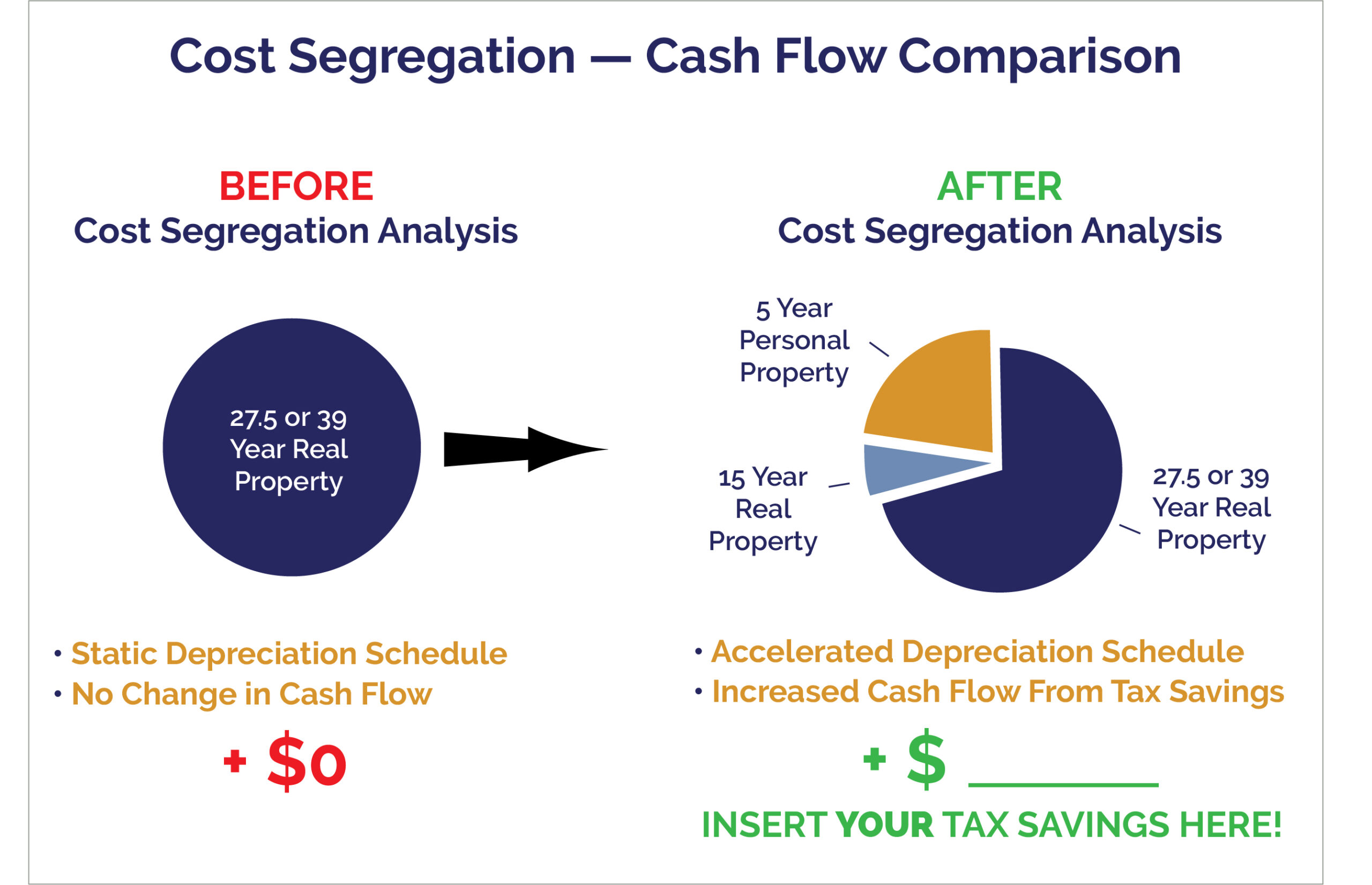

At its core, cost segregation is a tax strategy that enables property owners to accelerate depreciation deductions on certain components of their real estate investments. Rather than adhering to the traditional straight-line depreciation over 27.5 or 39 years, this technique allows for the segregation of building components into shorter lives—typically ranging from 5 to 15 years. But what does this mean for someone drawing W2 income? Can this strategy really provide relief?

Let’s delve deeper. First, it’s imperative to grasp how the tax structure works for W2 employees. Those who earn a salary through an employer are subject to withholding taxes, often finding themselves in a higher tax bracket as their income rises. These tax liabilities can feel insurmountable, especially for someone paying substantial amounts on their hard-earned wages.

Now, consider the mechanics of cost segregation. Property owners undertake this study, usually conducted by professionals, which identifies and categorizes various components of the property. For instance, while the building itself might be depreciated over a traditional timeline, assets like fixtures, landscaping, and certain enhancements can be depreciated much quicker. Consequently, this accelerated depreciation results in increased upfront tax savings.

But how does this degenerative dance with your W2 income work? The crux of the matter lies in the offset. By employing cost segregation effectively, property owners can generate substantial losses on paper—losses that can be used to offset income in the same year. If you’re a W2 employee who also owns rental properties, this becomes particularly advantageous.

Let’s dissect a hypothetical scenario. Imagine someone who earns $150,000 a year from their job. Unfortunately, with that salary comes a hefty tax bill. However, if this individual owns a rental property and decides to undertake a cost segregation study, they might uncover rapid depreciation of certain elements amounting to a loss of $50,000. This loss effectively reduces their taxable income to $100,000. It’s a remarkable opportunity to mitigate some of the tax pressure they face from their primary earnings.

While this presents an avenue for tax relief, there’s an essential caveat. The losses from the property may only be used to offset income that is categorized as passive unless the individual qualifies as a real estate professional. The IRS maintains stringent rules governing this classification, requiring a certain threshold of time and activity dedicated to real estate activities. This brings us to a playful inquiry: Are you ready to transform your real estate pursuits from a passive venture into a dynamic, active endeavor?

This challenge can be daunting for those who are simply dabbling in real estate as a hobby. If you view it purely as an investment—as many investors do—then the passive loss rules constrict your ability to fully leverage these cost segregation benefits. However, for those ready to immerse themselves in real estate, keeping detailed logs and utilizing time effectively can pave the way for immense tax benefits.

Cost segregation thus stands as a two-sided sword. While it can serve as an extraordinary tool for property owners aiming to alleviate their tax burdens, operating as a real estate professional can present a genuine hurdle. This concept often prompts individuals to reconsider their engagement level with real estate. It encourages a deeper investigation into not merely owning property but engaging with the real estate market at a meaningful level.

Moreover, there’s another layer that requires consideration—depreciation recapture. Should you ever choose to sell the property, you might be subject to recapture taxes on the depreciated amounts. Thus, while cost segregation offers immediate alleviation, it can turn into a complex web of future tax implications. As you contemplate potential savings, don’t forget to gaze into the crystal ball of your financial future.

Lastly, the realm of tax legislation is ever-evolving. Understanding the nuanced environment of tax reforms, policies, and regulations is vital. Cost segregation is a powerful strategy, but one must tread carefully. Matching strategic objectives with compliance requirements cannot be overstated.

So, can cost segregation offset W2 income? The answer is a resounding “maybe.” It’s contingent on multiple factors including your engagement in real estate, how much you feel comfortable with that business, and your readiness to navigate the associated tax implications. The potential advantages are undoubtedly enticing, yet the challenges and stipulations require thorough understanding and planning.

As you ponder this intriguing prospect, are you ready to transform your tax strategies? It’s time to contemplate whether embracing the principles of cost segregation could be your pathway to experiencing tax relief on your W2 income. Engage, educate, and elevate your financial acumen as you traverse the intricate dance of taxes and real estate.