In the realm of finance, law, and governance, the intersection of trust and transparency has become increasingly significant. This evolution stems from a growing realization that understanding the true ownership structures of entities is crucial for combating financial crimes, such as money laundering, tax evasion, and other illicit activities. One particular focus within this discourse is the inquiry into Beneficial Ownership Information (BOI)—specifically, whether trusts should be mandated to file such information. This article delves into the nuances of this pressing issue, the nature of trusts, and the implications of transparency in ownership.

To begin with, it’s essential to delineate what is meant by Beneficial Ownership Information. Beneficial ownership refers to the natural persons who ultimately own or control an entity, regardless of the legal form it takes. It encompasses individuals who, directly or indirectly, exercise significant control over a trust, partnership, corporation, or similar entity. Thus, BOI seeks to shine a light on these individuals, moving beyond the mere legal structures that can obscure their identities.

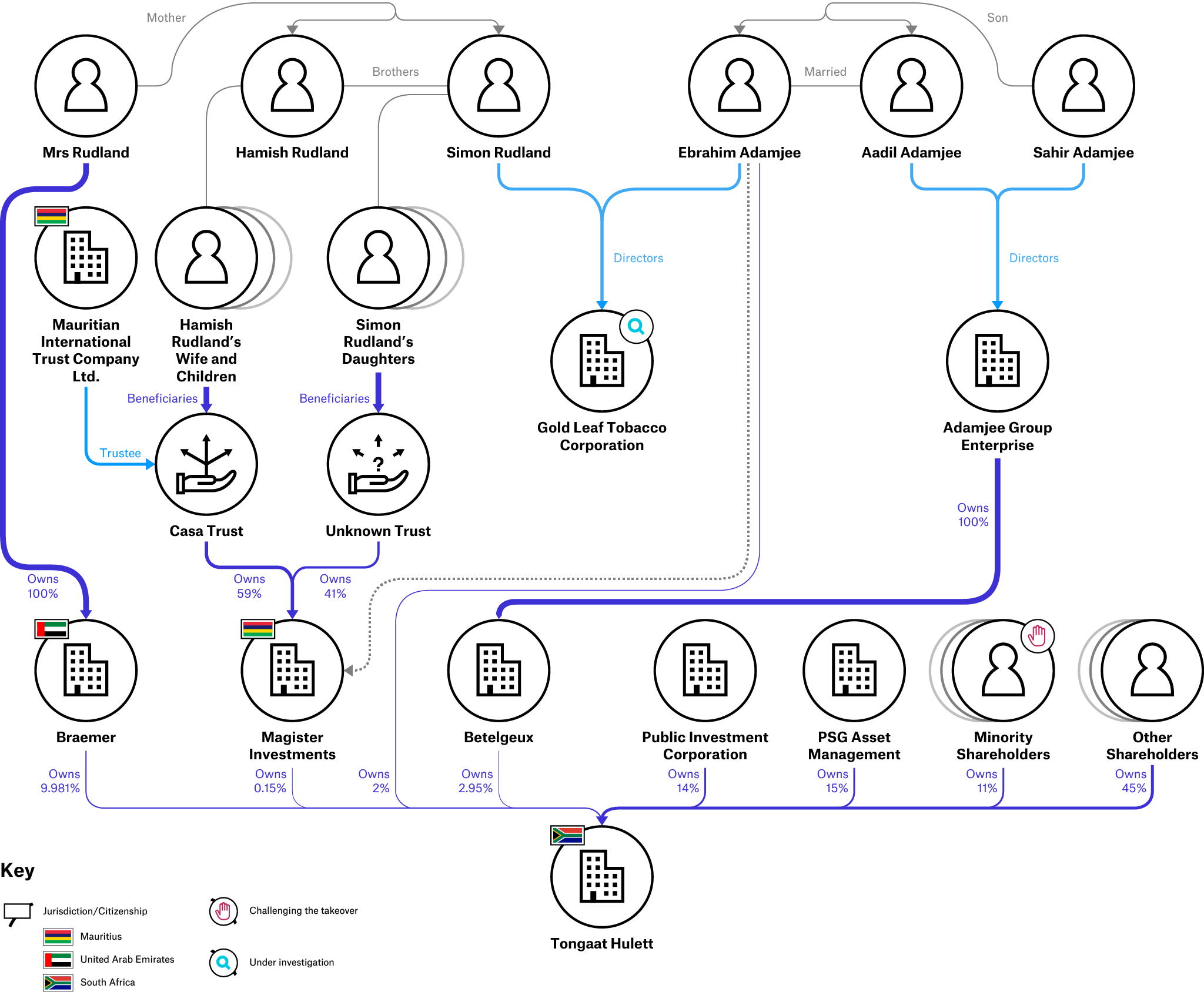

Trusts, as unique legal arrangements, present specific challenges in the realm of beneficial ownership. They allow for the separation of legal ownership and beneficial enjoyment of assets. Essentially, a trust is a fiduciary relationship wherein one party, the trustee, holds and manages assets on behalf of another, the beneficiary. This intricate dynamic can complicate the identification of beneficial owners, rendering transparency vital yet challenging.

There are various types of trusts, each with its own characteristics and purposes. Revocable trusts, commonly established for estate planning, allow the grantor to retain control over the assets and amend the trust during their lifetime. In contrast, irrevocable trusts involve a relinquishment of control by the grantor, making the assets difficult to reach for creditors and beneficial for tax planning. Furthermore, there are charitable trusts, which exist for philanthropic purposes, and special needs trusts, which provide for individuals with disabilities while preserving their eligibility for government assistance. This diversity in trust structures raises critical questions about the necessity and implications of requiring trusts to disclose their beneficial owners.

The primary argument for requiring trusts to file BOI is rooted in enhancing accountability and deterring wrongdoing. By creating a framework in which the true beneficiaries are documented and made accessible, authorities can more effectively track illicit activities. Transparency acts as a deterrent against potential misuse of trusts for concealing assets or facilitating criminal enterprises. In jurisdictions like South Africa, the need for trust transparency has been highlighted in various legal reforms, particularly in efforts to comply with global standards set by the Financial Action Task Force (FATF).

However, the implementation of such requirements is fraught with complexities. Critics often argue that mandating trusts to disclose their beneficial owners could undermine the fundamental privacy rights of individuals. Trusts are frequently employed as tools for asset protection, and exposing beneficial ownership could render individuals vulnerable to harassment, litigation, or other forms of undue scrutiny. This contention underscores a fundamental tension between the laudable goal of transparency and the inherent right to privacy.

Moreover, determining who qualifies as a beneficial owner can become convoluted in the context of trusts. For example, if a trust has multiple beneficiaries, should all be identified or only those with significant control? Furthermore, what occurs in the case of discretionary trusts, where beneficiaries do not have a fixed entitlement, complicating the identification process? These intricacies necessitate thoughtful legislative approaches that can accommodate the unique structures of trusts while still advancing the cause of transparency.

Countries have diverged in their approaches to regulating trusts in relation to BOI. Some jurisdictions have established specific registries mandating the disclosure of beneficial ownership of trusts. Others have opted for a more lenient regulatory framework that allows for certain exemptions, thereby balancing transparency with privacy. It’s noteworthy that the success of any regulatory regime hinges on robust enforcement mechanisms. Without appropriate penalties for non-compliance, transparency measures may become little more than aspirational goals.

In addition to regulatory frameworks, the role of technology in enhancing transparency cannot be overlooked. Innovations such as blockchain could potentially provide immutable records of ownership that are hard to manipulate. This could facilitate greater trust in the system, providing both privacy protection and transparency. However, the emergence of such technologies raises its own questions regarding regulation, data protection, and cybersecurity.

Moving forward, the ongoing dialogue surrounding trusts and BOI will likely evolve, influenced by various socio-economic factors. It is imperative that this conversation includes diverse perspectives, weighing the interests of privacy against the imperatives of accountability. Stakeholders—including lawmakers, financial institutions, and the broader public—must engage collaboratively to craft solutions that serve the common good while respecting individual rights.

In conclusion, the question of whether trusts should be mandated to file Beneficial Ownership Information is inherently multifaceted. As society grapples with understanding the importance of transparency in ownership structures, particularly in mitigating threats posed by financial crimes, the challenge will be to find a balance between transparency, privacy, and practicality. The future of trust regulation will not only shape the financial landscape but will also reflect our collective values as we navigate the complexities of an increasingly interconnected world.