When contemplating retirement, one cannot sidestep the complexities of Social Security, particularly when it comes to understanding the Windfall Elimination Provision (WEP). This intricate regulation affects how benefits are calculated for those who have earned pensions from work not covered by Social Security. But here’s where it gets interesting: What if the earnings from your work in the UK count as “substantial earnings” for Social Security? Are they enough to influence your eventual benefits? This probing question leads us into the nuanced interplay of international pensions and Social Security eligibility.

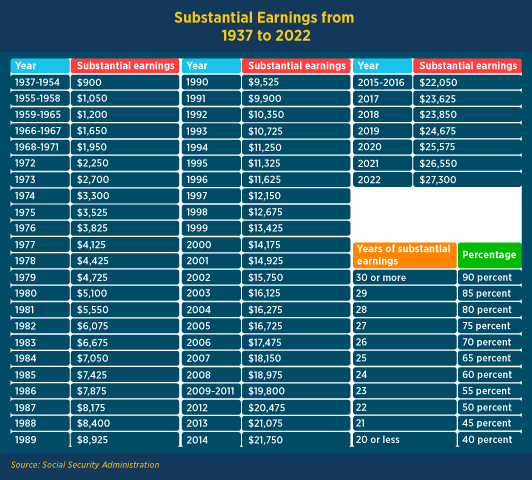

Before diving into the depths of this topic, let’s clarify what substantial earnings mean within the context of Social Security. The Social Security Administration (SSA) designates amounts annually, which, if exceeded, can affect your benefits. For the 2023 year, that threshold sits at $29,700. Earnings above this amount typically garner full credit towards Social Security benefits, but what happens when these earnings come from UK contributions? Does working abroad enrich or diminish your retirement dreams?

To begin, it’s pertinent to grasp what qualifies as “substantial.” In the realm of Social Security, this usually refers to income that meets or surpasses a specific earnings ceiling over a given timeframe. In contrast, the UK operates under its own system, offering contributions that accumulate through the National Insurance Scheme. The two systems do not always align, which paves the way for misunderstanding and, at times, frustration.

The crux of the issue resides in whether those National Insurance credits translate into substantial earnings for Social Security purposes. The SSA has established a formula denoting how pensions from non-covered employment—like that which is prevalent in the UK—can alter the benefit calculations for individuals receiving or anticipating Social Security. But this formula is not as straightforward as one might hope; it operates on the premise of earning credits based on the amount contributed over a working lifetime. So, are the credits from the UK substantial enough to require consideration under the WEP?

As one sifts through this intricate web, an important factor arises: the total number of years worked. Generally, the SSA requires 40 work credits for eligibility, which translates to approximately ten years of substantial employment in the US system. If you have spent the bulk of your career in the UK, where National Insurance contributions accumulate based on different criteria, this uniformity in calculation becomes questionable. Can credit from years spent abroad be juxtaposed neatly with a Social Security framework that uses an entirely different set of evaluations?

This dilemma is compounded by the infamous WEP, which aims to adjust benefits for those who have both substantial earnings in a “covered” career and pension from a “non-covered” source, like a UK pension. The existence of WEP is a double-edged sword; while it attempts to offer equity, it can inadvertently penalize those grappling with international work history. After all, if you’ve paid into a system abroad and built your career there, only to have WEP encumber your benefits, how fair is that?

Understanding the mechanics of WEP necessitates grappling with a series of calculations that could undoubtedly make even the savviest financial planner’s head spin. When determining benefits under the WEP, a reduced formula kicks in: the first $1,115 of averaged indexed monthly earnings (AIME) will lead to a benefit calculation that is diminished compared to what a consistent contributor to Social Security would receive. This process underscores the importance of not merely focusing on the pensions accrued through employment overseas but also acknowledging how they interlace with domestic Social Security benefits.

This isn’t merely an academic exploration—it’s a matter of potential financial destiny. If your UK earnings lend themselves to a lower perceived marginal income for Social Security, could that affect your lifestyle post-retirement? Furthermore, how might your financial plans shift upon awakening to the reality of WEP? The answers to these questions compel one to consult with a financial adviser who is well-versed in the interplay of international earnings and Social Security benefits.

For those who are worried that WEP will drastically erode retirement security, there’s a silver lining. The SSA permits individuals to attain a property that might benefit from “substantial” earnings through a totalization agreement with the UK, aiming for benefits reciprocity. Thus, though the labyrinthine process might initially seem daunting, there are avenues to explore and agreements to leverage to highlight substantial work history that could mitigate WEP-related reductions.

As you navigate this challenging landscape of international work history and Social Security, consider adopting a proactive stance. Document and verify all your earnings and contributions in both systems. Engage with resources dedicated to assisting expatriates or those with convoluted employment histories. Knowledge is power, especially when it comes to ensuring that your retirement reflects the lifetime of toil you have diligently put into your career.

Ultimately, the exploration of whether UK credits are deemed substantial earnings under Social Security isn’t just a matter of financial mathematics; it encapsulates the broader narrative of how we value work in a global economy. The world has become more interconnected, and how we perceive retirement benefits should likewise evolve. As you contemplate retirement, allow yourself to ponder this: in the grand scheme of things, do UK credits pave a sturdy path to mitigating WEP’s pitfalls? Only through thorough inquiry can one hope to uncover those elusive answers that could make all the difference in a secure retirement.