If you have a job that pays $43.27 per hour, you might find yourself pondering the implications of this hourly wage on your annual income. Let’s break down the numbers and unveil the full financial picture. Understanding your annual paycheck based on an hourly wage transcends mere arithmetic; it also involves an examination of your lifestyle, financial planning, and future prospects.

To start, let’s calculate the straightforward arithmetic. Assuming a full-time job typically consists of 40 hours per week and approximately 52 weeks in a year, the basic formula becomes:

$43.27 (hourly wage) x 40 (hours/week) x 52 (weeks/year) = Annual Income

When we perform the calculations, the equation reveals that the annual income amounts to:

$43.27 x 40 = $1,730.80 (weekly income)

$1,730.80 x 52 = $89,657.60 (annual income)

Thus, if you remain in a steady position earning $43.27 per hour for an entire year of full-time work, your gross annual income would be approximately $89,657.60. This figure sets the stage for deeper financial considerations.

Now that we have established a rough estimate of your gross income, let’s delve into the realm of deductions. It’s crucial to consider the various deductions that may come into play, such as taxes, health insurance, retirement contributions, and other payroll deductions. The gross income serves as a precursor to comprehending your take-home pay—the actual money you can allocate toward living expenses and savings.

Typically, federal income tax brackets vary based on your filing status and the number of dependents. For instance, in the United States, marginal tax rates can range from 10% to 37%. To refine your understanding, let’s assume a marginal tax rate of 22% for much of the income earned at this level. When factoring this in, the necessary calculations yield:

$89,657.60 x 0.22 = $19,704.67 (estimated federal tax)

$89,657.60 - $19,704.67 = $69,952.93 (after federal tax)

Don’t overlook state taxes, Social Security, and Medicare contributions, as these could further erode the gross amount. The specifics can vary tremendously depending on your locale. Thus, a more holistic approach will empower you to ascertain your precise earnings.

Life tends to be complex, involving expenses such as housing, food, transportation, and various other commitments. With that in mind, let’s contemplate the significance of budgeting based on your newfound understanding of your income. Creating a budget that reflects your priorities is paramount. The allocation of funds towards essential living costs, discretionary spending, and savings must be a well-thought-out process.

Furthermore, establishing an emergency fund is vital. Financial experts typically recommend setting aside three to six months’ worth of living expenses. This cushion serves as a safeguard against unforeseen circumstances, such as medical emergencies, job loss, or urgent repairs. If you earn a net income of approximately $69,952.93, your budgeting strategy can revolve around ensuring that a portion of your earnings is consistently directed toward this fund.

In addition to budgeting, consider the broader horizon ahead. Earning $43.27 per hour can potentially lead to progressive career advancements. Cultivating your skills, pursuing education, or seeking further certifications may provide opportunities for salary increases or promotions. Setting career goals and charting a pathway toward them can transform your financial future significantly.

Retirement planning is another essential facet of managing your income. The earlier you start, the more you benefit from compound interest. Employers often offer retirement plans with matching contributions. If eligible, contributing to these plans can be an astute financial strategy. With a gross income yet to be taxed, consider the implications of investing a percentage of your paycheck into retirement accounts. Over time, these contributions—augmented by employer matching—can yield significant financial dividends.

Consider health insurance, as it not only ensures your medical needs are met but also represents a considerable budget line. Often, employers subsidize these costs, and understanding what is available to you can further aid in budgeting effectively. Once you have clarity on your health coverage options, ensuring adequate coverage becomes a pivotal consideration.

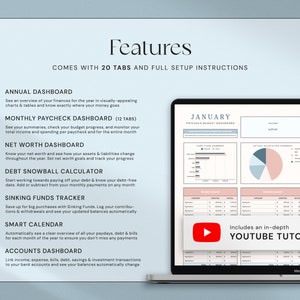

In navigating the transition from earning an hourly wage to understanding your annual income, it’s crucial to appreciate the nuances of personal finance. Educational resources, budgeting tools, and financial planners can all lend a hand in shaping a financial landscape that supports your lifestyle and aspirations. Make use of spreadsheets or financial software to track your progress, assess spending habits, and instill discipline in your financial decisions.

In conclusion, converting an hourly wage to an annual salary provides you with a launching point for financial exploration. Evaluating the entirety of your financial well-being involves understanding net income, formulating budgets, and planning for the future—whether that be through retirement savings, investing in education, or building an emergency fund. As you embark on this journey, remember that knowledge is power. Stay informed, remain mindful of your goals, and make financial literacy an integral part of your life.