As the dust settled on the economic landscape of 2011, a remarkable shift in the estate tax landscape began to take root. The estate tax, a crucial facet of the American tax system, often evoked emotions ranging from indignation to indifference. This year marked a pivotal juncture, redefining not only the chronology of wealth transfer, but also the stratagems employed by inheritors and policymakers alike.

In 2011, the estate tax threshold climbed to an impressive $5 million per individual, a significant increase from previous years. This legislative maneuver was not merely a response to economic pressures but a clarion call to reevaluate how wealth was perceived and distributed in society. The implications were profound: families with estates beneath this threshold were exempt from taxes altogether, thus enabling them to preserve their legacies without the looming specter of taxation.

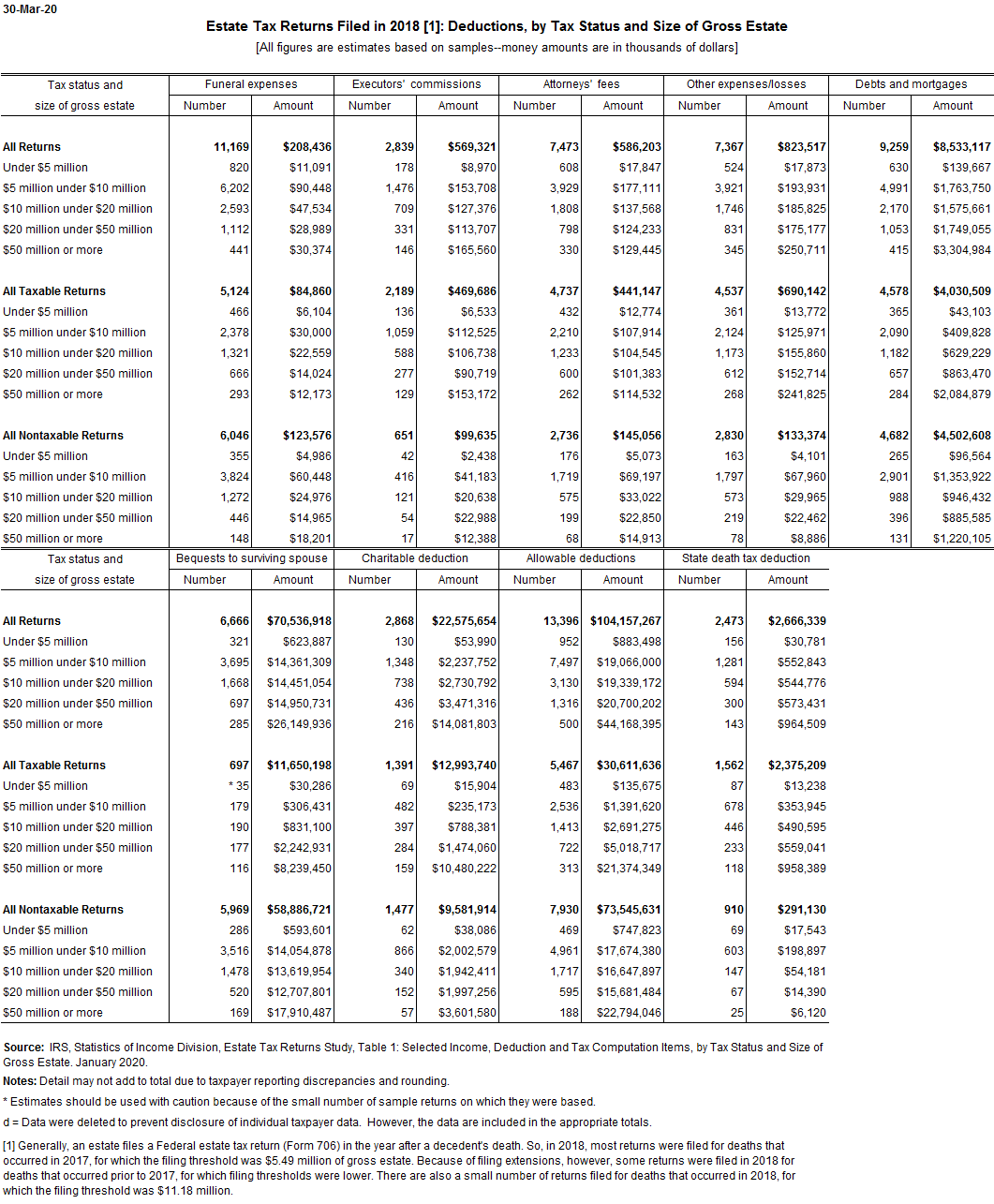

As we delve deeper into the statistical abyss, the interplay of deductions comes into focus. Estate returns, which documented the assets’ fair market value at the time of a decedent’s death, revealed a tapestry of deductions being utilized. Taxpayers were increasingly employing strategies to navigate the complex tax code, relying on deductions for debts, charitable donations, and administrative costs associated with settling estates. This not only fortified financial strategies but also unmasked a growing awareness of the multifarious opportunities available to mitigate tax burdens.

Moreover, the 2011 estate tax revisions illuminated the sociopolitical tensions surrounding wealth and taxation. Advocates for estate tax repeal argued fervently against the perceived injustices of taxing what had already been accumulated, while opponents underscored the necessity of such taxes for societal equity. The discourse was not just about numbers; it was a philosophical debate about responsibility, privilege, and the moral imperatives of wealth distribution.

Transitioning from policy to personal narratives, the 2011 estate tax scenario compelled individuals to reconsider their legacies. With fewer families facing the brunt of estate taxes, conversations around inheritance morphed into contemplative ruminations on values, aspirations, and the essence of leaving a mark on future generations. Soon, it became evident that the estate tax was not a mere financial instrument; it was a medium through which families articulated their narratives and imparted their values.

Thus, the estate tax returns of 2011 promise not just statistics, but a profound shift in perspective. As individuals and families navigated the tributaries of wealth transfer, they were not only confronting financial realities but also engaging in a larger dialogue about societal values and intergenerational equity. The data from this period serves as a lens through which we can understand the evolving narrative of wealth in America, challenging us to scrutinize entrenched beliefs and consider the ramifications of policy changes on familial legacies.