Dentist retirement is an intriguing subject that opens a window into the intricate dance between financial preparedness and professional trajectory. The average net worth of dentists at retirement is often a pivotal consideration not just for the individuals themselves, but also for students navigating the expansive field of dental medicine. As society grapples with the realities of financial stability, the statistics surrounding dentist retirement become an essential conversation starter.

Understanding the average net worth in this profession requires a closer examination of several intertwining variables. Firstly, years of practice play a substantial role. Most dentists undergo rigorous training, spending upwards of eight years in higher education before entering the workforce. This investment of time and resources often leads to an initial wage that might seem exorbitant, yet debt management becomes a pressing issue soon thereafter. As student loans burden many upon graduation, attaining financial security may take years, if not decades.

In general, dentists earn a lucrative salary that can significantly affect their net worth. Varying by region and type of practice, the average annual income for dentists in the United States typically ranges from $150,000 to over $200,000. However, despite the seemingly substantial income, variables such as overhead costs, expenses related to maintaining a practice, and personal spending habits can considerably dilute take-home earnings. Thus, while the top-line revenue seems promising, the net savings that directly contribute to one’s net worth might not be as substantial as anticipated.

Moreover, dentists, like many professionals, face the immediate challenge of setting aside adequate funds for retirement. Unlike employees in other sectors, many dentists are self-employed or own their practices; this scenario requires them to be far more proactive regarding savings and investments. The lack of employer-sponsored retirement plans means they must navigate the labyrinth of retirement savings independently. Options such as 401(k) plans, IRAs, and Health Savings Accounts (HSAs) become critical tools for those in the dental profession.

Interestingly, the concept of retirement often provokes a psychological response that reflects broader societal norms. Dentists, much like other professionals, internalize cultural expectations around retirement, often viewing it as a reward after years of labor. This mindset can skew perceptions of net worth acquisition, as it is not merely about accumulation but also about readiness to step away from one’s career. The fascination with how dentists accumulate wealth for retirement reflects on the broader implications of lifestyle choices, investment strategies, and personal goals.

As individuals transition toward retirement, considerations become increasingly complex. Dentists need to contemplate their exit strategies and the long-term viability of their practices. Selling a practice can yield significant revenue, thus influencing the overall net worth. The valuation of a dental practice varies significantly based on location, patient base, and equipment condition, with averages sometimes reaching several hundred thousand dollars or more. This transaction, however, demands a strategic approach, with factors like market timing and buyer interest playing crucial roles.

Investment in real estate or other business ventures is also prevalent among dentists seeking to bolster their financial portfolio. Whether acting as passive investors or diving into property management themselves, many who enter retirement find that diversifying their assets can provide financial stability. Real estate, for example, offers opportunities for passive income through rentals or appreciation over time, thus enhancing net worth.

In addition, the nuances of personal finance advice tailored specifically for dentists cannot be underestimated. The unique challenges faced by dental professionals call for targeted financial planning encompassing taxes, insurance, and estate planning. Engaging with a financial advisor experienced in serving dentists can yield significant benefits. With guidance, cash flow can be managed effectively, ensuring that retirement money is adequately allocated.

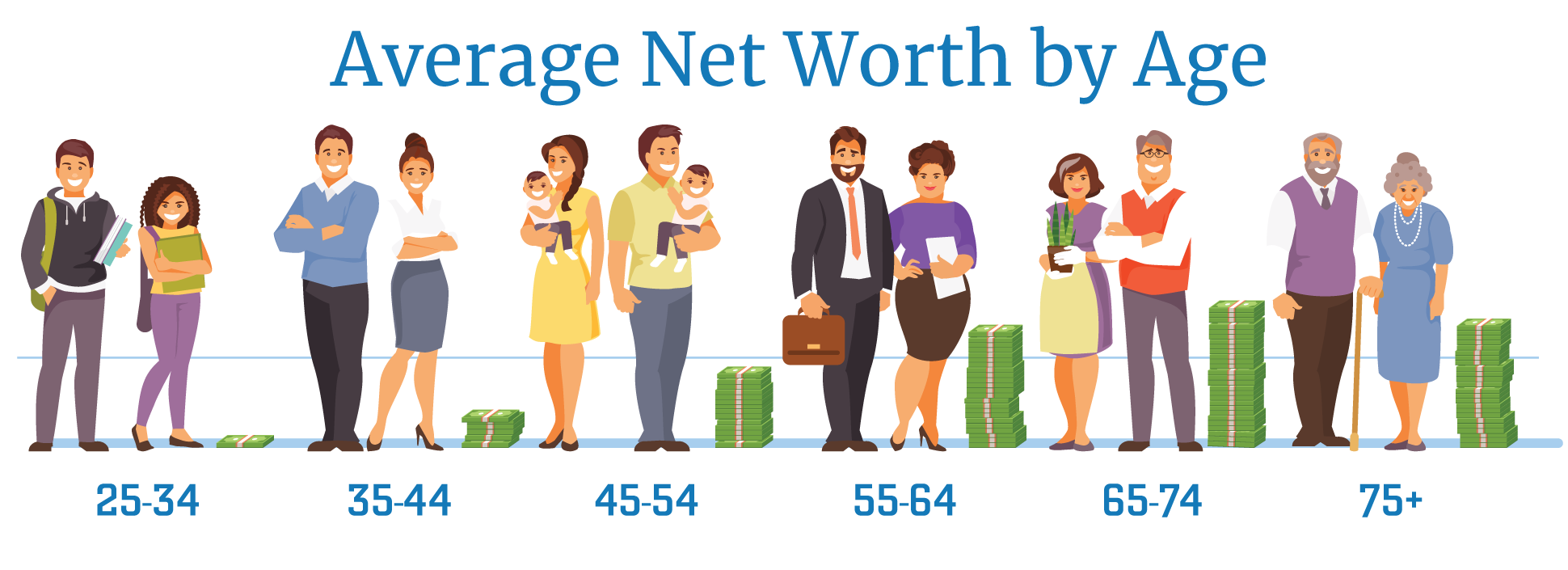

Another dimension influencing net worth among retiring dentists is the growing trend of longevity in healthcare professions. With advancements in healthcare and a greater emphasis on holistic wellness, many dentists are practicing well into their sixties or seventies, thus altering traditional retirement timelines. This demographic shift also influences net worth trajectories, with continued income enabling higher levels of savings over an extended period.

Dentists, motivated by their passion for patient care, often struggle with the concept of stepping away entirely from their practices. This difficulty can lead to transitional roles where dentists continue to mentor younger professionals or work part-time. Such arrangements provide a bridge between full-time practice and retirement, often resulting in more gradual financial transition. This extended engagement can have a profound impact on net worth, as continued income generation complements a retirement plan.

Finally, there is societal value in the average net worth of retiring dentists. Their financial outcomes serve as a reflection of the healthcare system at large, shedding light on disparities in income and the economic wellbeing of professionals dedicated to community health. A dentist’s net worth at retirement can reveal broader economic realities while also providing a benchmark for aspiring professionals. In exploring the average net worth of dentists nearing retirement, a tapestry of stories unfolds—each exemplifying resilience, adaptability, and the need for thoughtful planning in an ever-evolving profession.

In conclusion, the average net worth at retirement for dentists interlinks a multitude of factors including education costs, income levels, practice management, investment strategies, and evolving societal norms. The fascination surrounding this financial aspect serves not only to inform current practitioners and students but also reflects the broader realities of financial preparedness in the modern economy. Understanding these intricacies will be invaluable for dentists as they navigate their professional journeys toward their retirement goals.